Take for example predictions of the market surging to new highs or the market crashing; the fact is that the same experts play both sides of the game and usually they are late to the party. Let’s take this a step further; for argument sake let’s assume that the markets are guaranteed to crash in 2018. The same experts made the same claims in 2013, 2014, 2015, 2016 and 2017. Had you listened to them just once and followed their advice over the past five years you would have a lost a small fortune. How are these guys still standing? They don’t follow their advice, they make money by selling this faulty information to you.

What if there was a better way to look at the situation. The experts are like illusionists; they twist the data and paint a false picture. In essence they are recreating reality. Based on an examination of historical records, these experts have a dismal record; they make a monkey with darts look like Einstein by comparison.

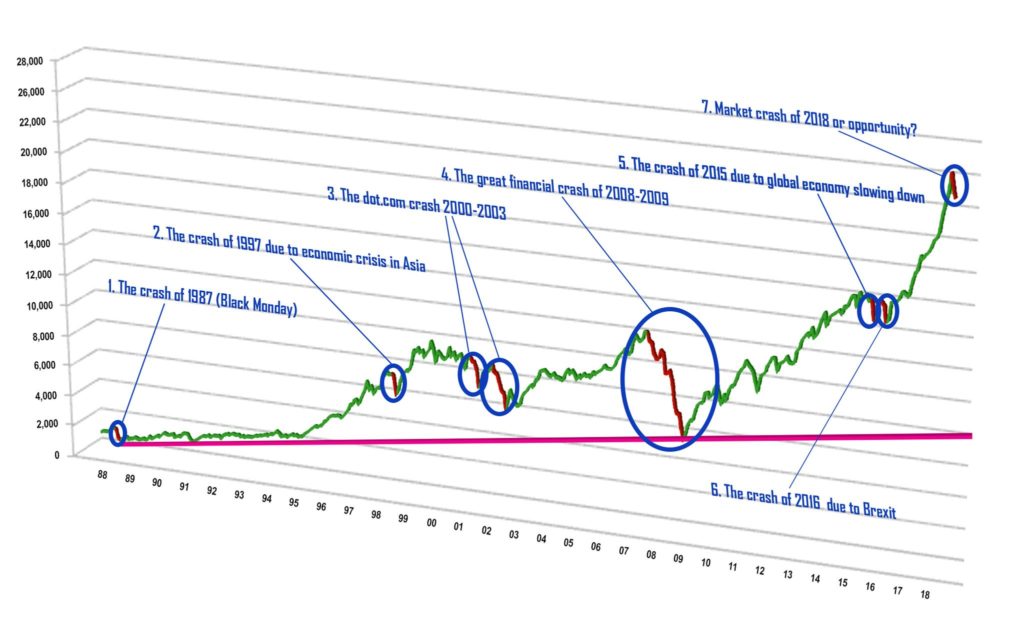

Take a look at the chart below; it immediately becomes clear that the experts are misleading the masses and that every stock market crash turned out to be a “once in a lifetime buying opportunity”.

Regardless of how sharply the markets pulled back they always recouped those losses and then went to rally to new highs. “Black Monday” one of the most remembered crashes of all times looks like a tiny blip on the chart, yet experts use it all the time to scare the masses of upcoming crashes. Take a close look, every so-called end of the word crash including the devastating dot.com crash proved to be a buying opportunity. However, you should know when to buy and when to sell and we will address that shortly.

Putting the founding principles of Mass Psychology into play would have yielded spectacular results over the years. The principle is very simple and effective; buy when the crowd is stampeding, and sell when the crowd is euphoric.

Our system has psychological components built into it eliminating the “noise factor” and it focuses on the underlying trend. It removes any second guessing and pinpoints when you should buy or sell. We will address this system shortly, but first, we would like to illustrate our system in action. To show that we are impartial we are not going to provide links only to the site, but to a host of highly rated financial sites that published our articles

Already convinced? -Then you can go straight to the signup page. If you need more information please continue reading

Jan 24, 2018; our downside targets for bitcoin

When all the experts were proclaiming that Bitcoin was destined to soar to the moon, we begged to differ and instead we issued downside targets most of which were hit.

On the conservative side, we think Bitcoin could drop down to the 8,800-9,200 ranges, but this market is far from your typical market, and there is a good chance that Bitcoin could drop down to the $5000-$5600 ranges before the dust settles.

For those who want to play the bitcoin market, a somewhat safer alternative would be via Bitcoin Investment Trust (GBTC). Its quite liquid and you can jump in and out with the click of a mouse. Consider waiting until the sentiment turns decidedly negative or bitcoin is trading at least in the $8000 ranges before deploying some of your funds Market Oracle

Dec 4, 2017; our warning that the Bitcoin Mania was out of hand and that a correction was close at hand

Bitcoin, on the other hand, is now in the feeding frenzy stage, so this market is ripe for a correction. GoldSeek

Nov 10, 2016, when the markets were getting jittery about a Trump Win

Regardless of what you think of Trump, he is having the same effect as Brexit had on the markets but in smaller doses. If he should win the election, then the reaction will be several magnitudes larger. When the poll results came in stating that Hillary fared better in the 1st debates the markets responded positively and recouped their losses; this reinforces our argument of several years that says substantial pullbacks should be viewed as buying opportunities.

From a contrarian angle (and not a political point of view) a Trump win could be construed as a positive development; non-contrarians will demand to know why? Mass Psychology clearly states that the masses are always on the wrong side of the equation. A Trump win will create uncertainty, and the lemmings will flee for the exits; markets will pull back sharply and viola the same old cycle will come into play. The cycle of selling based on fear which equates to opportunity for those who refuse to allow their emotions to do the talking. Safe Haven

Oct 2015 when the markets were crashing

Mass psychology clearly states that markets usually run into a brick wall when the Crowd is Euphoric and chanting “Kumbaya my love”. This is not the case yet and sentiment is far from the euphoric zone. This is one of the most hated bull markets in history. Market Oracle

We went one step further and issued these targets

We have a fair amount of resistance in the 17300-17400 ranges. The ideal set up would be for the Dow would trade in these ranges, with a possible overshoot to 17,600 and then proceed to test 16,500-16,600 ranges Market Oracle

Feb 8, 2010; we stated the markets were very overbought and needed to let out at least 1500 points.

To let out enough steam and move the risk to reward ratio in our favour, the Dow would have to at the minimum shed 1500-1800 points, and so far it barely shed 700 points. Tactical Investor.

In April the Dow traded to 9150, and by June it had already shed more than 1500 points. As the trend was positive, there was no need to panic as these proved to be buying opportunities.

In Sept 2009, we stated it was a good time to invest in Gold, Silver and palladium. We also advocated buying strong non-commodities based stocks.

Use Strong pullbacks in the Gold, Silver and Palladium markets to add to your bullion positions. Individuals willing to take on a bit more risk can purchase a basket of stocks connected to the commodity’s sector. Lastly, (besides investing in the commodity sector), buying strong stocks is a better play than investing in housing. We would focus on strong companies that have robust sales and that are trading in the overbought ranges. For example NTES, NFLX, ABMD, and BREW. Read full article

July 2008; a buying opportunity could be close at hand

The good news is that despite this massive sell off our smart money indicator has not reacted negatively and is trading well above its Jan 08 lows; it is also very close to actually issuing a full-fledged buy signal. Tactical Investor

In every example we cited above, and we could cite dozens more, experts such as Marc Faber, Peter Schiff, and a host of other popular guests on CNBC continuously stated that the markets would meltdown, but in each instance, we took an opposing stance. The only exception to the market meltdown story was Bitcoin; here the experts were sure that the market would soar to the moon and perhaps to the next galaxy, as wild insane of targets of $1 million were issued. James Altucher and John Macafee both stated that bitcoin could soar to a million dollars.

Ready to sign up? or Continue reading?

Why would the experts purposely misdirect the masses?

The obvious answer would be to save the opportunity for themselves. Think about it, if everyone understood this secret, and then they would not be able to make a killing, would they? For example, if you had just used every crash to buy top quality stocks for the past 20 years, you would probably be extremely rich by now. That’s the secret weapon that investors such as Buffett, Soros, Mark Mobius, Sir Templeton, Icahn, etc. use to become super rich.

The obvious answer would be to save the opportunity for themselves. Think about it, if everyone understood this secret, and then they would not be able to make a killing, would they? For example, if you had just used every crash to buy top quality stocks for the past 20 years, you would probably be extremely rich by now. That’s the secret weapon that investors such as Buffett, Soros, Mark Mobius, Sir Templeton, Icahn, etc. use to become super rich.

If you applied the same technique, you could also make a fortune. It’s called buy low and selling high, or a better term would be trend investing and that in a nutshell is how the smart money makes a fortune and they don’t want you to learn this secret.

The secret to making a fortune in the markets

The secret is very simple; it comes down to identifying the trend plain and simple. Once you know the trend, you can determine whether you should buy the dip or sell the rally. This is what is behind the concept of buying low and selling high. The big players in Wall Street are privy to information that’s not available to the small investor. Hence the term “insiders”; the trend indicator levels the playing field and gives the small guy the same window of opportunity to act on.

Our Ace Card: The Trend Indicator makes second-guessing a thing of the past

The Trend Indicator combines the finest elements of Mass Psychology with the very best of Technical analysis. The chart below highlights the trend system in action. As you will spot instantly, we are not interested in determining the exact top or bottom, which is a task best reserved for those who seem to thrive on pain. We focus on spotting the trend and on identifying hidden opportunities, hence the name the “trend indicator”. The trend indicator informs you if it’s time to buy the dip or sell the rally.

The trend indicator provides us with the same advantage the big market players have. Instead of joining the stampede we will look for strong stocks to buy during the so-called “market crash phase” provided the trend is up. If the trend is down (bearish), then we use rallies to short the market, conservative traders are advised to stay in cash.

You will never again have to worry about whether or not you should buy on the dip or sell into a rally. The trend indicator will take care of that; all you have to do is determine what stocks you want to buy. In fact, we will take care of that too, so if you don’t want to compile a list of stocks to buy you don’t have to. Just sit and wait for our instructions. To lower the risk even further, we focus on strong stocks that are trading in the extremely oversold ranges.

By keeping it simple, the trend indicator eliminates the “stress factor”. Everyone is busy today and time is of the essence, most individuals don’t have the time to pour of hundreds of charts or spend a countless number of hours on research. We utilise the KISS principle “keep it simple stupid.”

Ready to sign up? or Continue reading?

Many would charge thousands for such a system

But if we did that, it would be out of reach of the very people we are trying to help. Our goal is to give the average Joe the same advantage many of the top-rated firms on Wall Street have.

Not only have made the system affordable but today we are throwing in an array of bonuses which will result in a savings of 72% for the life of the subscription. In other words, you will lock in this rate forever or until you decide to cancel.

But that’s not all look at the great list of bonuses we are offering

- Test Drive the service for 30 days for only $19.99 with no obligation. That’s 66 cents a day and much less than you would pay for a coffee at McDonald’s.

- Receive the ETF Trend Trader service for free, priced at $25 a month

- Free Trading Manual valued at $89.99

- The security centre that provides you with access to dozens of free utilities to protect you from the online threats we face today; value priceless.

- For the first ten subscribers, we are offering this exclusive report “The best ten stocks to own over the next ten ”

We have been around for 14 years which proves we are not some fly by night operation. And remember there is no obligation for you to stay if you are not satisfied. The cancellation process is easy and fully automated you are in charge all the time as we use PayPal.

Lastly, unlike most financial newsletter services we respond to every subscriber email.