Value Investing is dead Update Dec 2019

Value investing appears to be dead?

Many subscribers have asked us why we don’t focus or pay more attention to fundamentals. One of the main pieces of data EPS can and is being easily manipulated via share buybacks, so that puts the whole concept of value investing or investing based on fundamentals into the toilet. Secondly, the data is provided in a standardised format, which means that almost every investor that uses it will more or less arrive at the same conclusion.

Move to mass psychology; very few have even heard of this topic, and there is no standardised book or formula to follow. There are very few books that even cover the topic adequately, and almost none of these books apply the topic of MP accurately when it comes to investing. As when choosing a cure for erectile dysfunction. Technical analysis is also interesting in that regard, for its based on an individual’s interpretation of a given pattern. You have to see the pattern and no two traders will see the exact pattern. Furthermore, we take an out of the box approach when it comes to technical analysis, and for the most part, we customize all our indicators. In a nutshell, that is why we don’t pay too much attention to fundamentals, and this is not a new approach; we have maintained this stance for over 17 years.

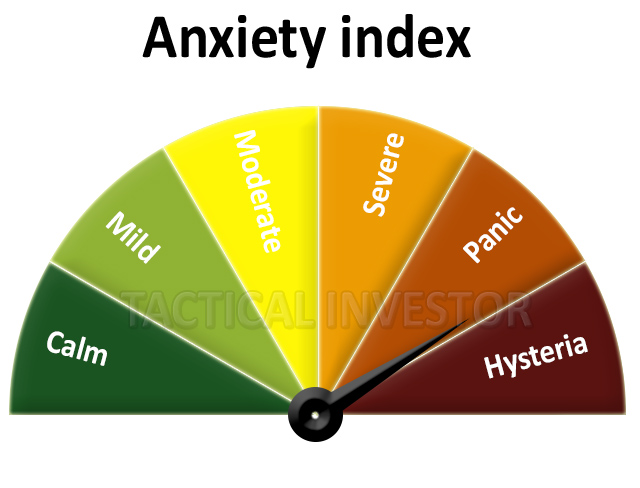

Whenever experts state that something is dead, hated or disliked, one has to start viewing that sector in a more favourable light. Value stocks are likely to start trending upwards shortly. We suspect one more wave of pain might be necessary to drive the last holdouts out of this sector. CALM is an example of a value stock. When the masses state something is dead, the opposite is usually true. Buy when the masses are panicking and run when they are Euphoric.

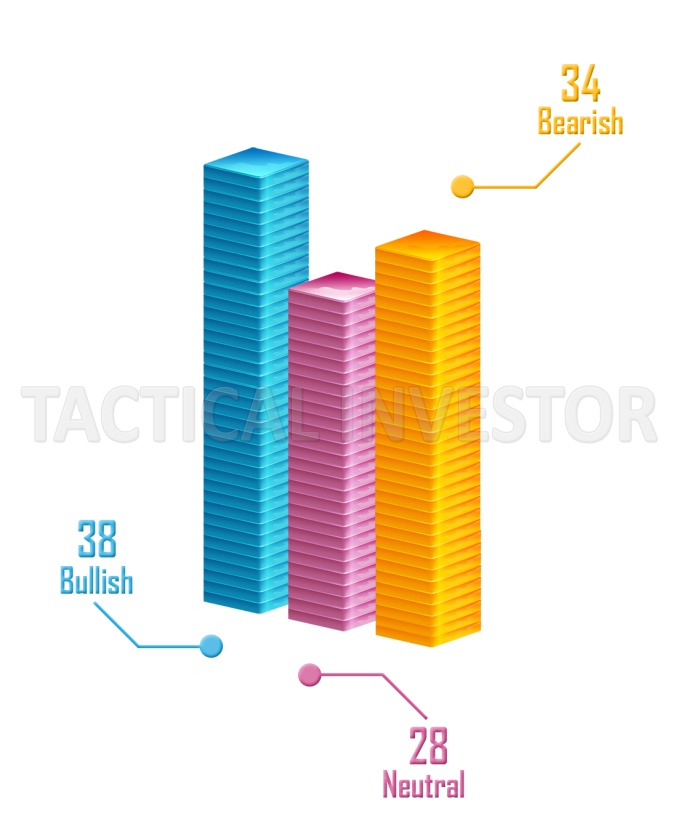

Market Sentiment

The small surge in bullishness appears to be short-lived, what remains constant is the number of individuals in the Neutral camp. Until the individuals in the bullish camp surge past 70% for several weeks in a row, the markets are unlikely to put in a long-term top. Corrections ranging from mild to strong is all most investors will have to worry about. Most of the pullbacks will be in the mild to medium ranges with the occasional pullback falling into the “strong” category. At this point, the odds that the SPX will trade to and past 3000 are now close to 70%.

Despite being extremely overbought, the trend for the major indices of the world (Germany, US, Australia, Britain, etc.) is up. The Australian markets are still extremely overbought both on the weekly and monthly charts, so at the least investors should wait till our indicators on the weekly charts pullback to the oversold ranges.

This market is in sore need of one strong pullback, but this market is irrational one cannot expect the market to pullback just because it’s trading in the extremely overbought ranges. Therefore our gameplan is to continue opening long positions in stocks that are extremely oversold on the monthly charts. This plan will remain in force until 1-2 of the major indices like the Dow, SPX or Nasdaq experience a bearish signal on the monthly charts.

This market is in sore need of one strong pullback, but this market is irrational one cannot expect the market to pullback just because it’s trading in the extremely overbought ranges. Therefore our gameplan is to continue opening long positions in stocks that are extremely oversold on the monthly charts. This plan will remain in force until 1-2 of the major indices like the Dow, SPX or Nasdaq experience a bearish signal on the monthly charts.

Though the Dow and the SPX are trading in the overbought ranges, on the weekly charts the Dow, as shown above, is gearing up to trend higher. The MACD’s have experienced a bullish crossover right at the halfway point (minimal oversold zone). We would not be surprised if the Dow traded to the 23650-23800 ranges in the near future.

Risk takers can use pullbacks ranging from 350-450 points to open long positions. The Dow does not need to pull back 350-450 points in one day. For example, it is currently trading slightly above 23400. Risk takers could open long positions from 22950 to the 23050 ranges.

Published courtesy of the Tactical Investor