Introduction to Day Trading Mistakes

Day trading, characterized by the buying and selling of financial instruments within the same trading day, can be both enticing and daunting. Many traders are drawn to the potential for quick profits, yet the pitfalls are numerous. Understanding day trading mistakes is crucial for anyone looking to navigate these turbulent waters. The stakes are high, and the margin for error is slim. By recognizing common errors, traders can develop strategies to mitigate risks and enhance their chances of success.

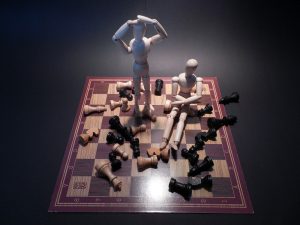

Mass Psychology in Day Trading

Mass psychology plays a significant role in day trading. The behavior of traders often mirrors that of the crowd, leading to phenomena such as panic selling or euphoric buying. When news breaks—be it positive or negative—traders often react impulsively, driven by fear or greed. This herd mentality can lead to substantial losses, especially for those who do not have a solid trading plan in place.

Warren Buffett famously stated, “Be fearful when others are greedy, and greedy when others are fearful.” This philosophy highlights the importance of maintaining a level head, particularly during volatile market conditions. For example, during the COVID-19 market crash in March 2020, many inexperienced traders sold stocks in a panic, missing out on a subsequent recovery. Those who remained calm and focused on their strategies often reaped the rewards.

Common Day Trading Mistakes

Numerous mistakes can lead to significant losses in day trading. Here are several common pitfalls that traders should be wary of:

1. Lack of a Trading Plan

A well-defined trading plan is essential for success in day trading. Without a plan, traders are more likely to react emotionally to market movements, resulting in rash decisions. According to Benjamin Graham, “The investor’s chief problem—and even his worst enemy—is likely to be himself.” This statement emphasizes the necessity of discipline in trading.

New traders often enter the market without a clear strategy, relying instead on tips from friends or social media. For instance, during the meme stock frenzy surrounding GameStop in early 2021, many traders jumped on the bandwagon without understanding the underlying fundamentals, leading to unpredictable losses.

2. Overtrading

Overtrading is another common mistake among day traders. The allure of quick profits can lead traders to enter and exit positions too frequently, resulting in excessive transaction costs and emotional fatigue. Jim Simons, a renowned quantitative trader, emphasizes the importance of data-driven decisions. Rather than making impulsive trades, traders should focus on high-probability setups that align with their strategies.

For example, a trader might feel compelled to make multiple trades in a single day, believing that more activity equates to higher profits. However, this can lead to diminishing returns and increased losses, especially if trades are made without sufficient analysis.

3. Ignoring Technical Analysis

Technical analysis is a vital tool for day traders, providing insights into price movements and potential market trends. Many traders make the mistake of ignoring technical indicators, relying solely on news or speculation. Philip Fisher, an influential investor, highlighted the importance of understanding market trends and conditions. Utilizing technical analysis can help traders make informed decisions and avoid costly mistakes.

For instance, a trader might overlook key support and resistance levels, leading to ill-timed entries and exits. Understanding chart patterns and indicators can provide valuable information, helping traders navigate market fluctuations more effectively.

4. Emotional Trading

Emotions can cloud judgment and lead to poor decision-making in trading. Cognitive biases, such as confirmation bias and loss aversion, can significantly impact trading behavior. Confirmation bias occurs when traders seek out information that supports their existing beliefs, often ignoring contradictory evidence. Loss aversion, on the other hand, leads traders to hold onto losing positions in the hope of a turnaround, resulting in greater losses.

As Charlie Munger aptly stated, “The psychology of man is the biggest obstacle in investing.” Successful traders must cultivate emotional discipline and the ability to detach from their trades. For instance, if a trader has a significant loss, the urge to recover quickly can lead to further mistakes, perpetuating a cycle of poor trading behavior.

5. Lack of Risk Management

Effective risk management is critical in day trading. Many traders neglect to set stop-loss orders or fail to define their risk tolerance, exposing themselves to significant losses. John Templeton once remarked, “The four most dangerous words in investing are: ‘This time it’s different.’” This quote underscores the importance of adhering to risk management principles, regardless of market conditions.

A trader who risks too much on a single trade may find themselves in a precarious position. For example, if a trader allocates a large percentage of their capital to one trade without a stop-loss, a sudden market shift could lead to devastating losses. Establishing clear risk parameters and adhering to them is essential for long-term success.

6. Failing to Adapt

Market conditions are not static; they can change rapidly due to various factors. Traders must be willing to adapt their strategies based on current market conditions. George Soros, known for his ability to anticipate market shifts, emphasizes the importance of flexibility in trading. A rigid approach may lead to missed opportunities and increased losses.

For instance, a trader who relies solely on a specific strategy during a high-volatility period may struggle to adapt when market dynamics change. Being open to adjusting one’s trading plan and strategies can help traders navigate unforeseen challenges more effectively.

7. Chasing Losses

Chasing losses is a dangerous habit that many day traders fall into. After experiencing a loss, traders may feel compelled to make risky trades in an attempt to recover quickly. This behavior often leads to impulsive decisions and further losses. As Jesse Livermore wisely noted, “There is nothing new on Wall Street. There can’t be, because speculation is as old as the hills.” This suggests that traders should understand the cyclical nature of markets and approach them with patience.

Instead of attempting to chase losses, traders should focus on their overall strategy and look for opportunities that align with their trading plan. A disciplined approach helps maintain a healthy mindset and reduces the likelihood of emotional decision-making.

8. Overconfidence

Overconfidence can be detrimental to day traders. After a series of successful trades, traders may develop an inflated sense of their abilities, leading them to take on excessive risks. According to Ray Dalio, “The best investors are the ones who are able to learn from their mistakes.” Acknowledging one’s limitations and being willing to learn is critical for long-term success.

For example, a trader who has recently experienced consecutive winning trades may become overconfident and ignore their established risk management practices. This can result in reckless trading decisions that jeopardize their capital.

9. Neglecting Continuous Learning

The financial markets are constantly evolving, and traders must prioritize continuous learning. Failing to stay updated on market trends, news, and new trading strategies can hinder a trader’s success. Paul Tudor Jones II emphasizes the importance of adapting to changing market conditions, stating, “You have to be willing to adapt.”

Traders should invest time in educating themselves through books, webinars, and mentorship opportunities. This commitment to learning can provide valuable tools for navigating the complexities of day trading and avoiding common mistakes.

Conclusion: Avoiding Day Trading Mistakes

In conclusion, understanding day trading mistakes is essential for anyone venturing into this fast-paced arena. By recognizing the influence of mass psychology, technical analysis, and cognitive biases, traders can develop strategies to mitigate risks and enhance their chances of success. The wisdom of experts like Warren Buffett, Peter Lynch, and Jesse Livermore serves as a reminder of the importance of discipline, emotional control, and continuous learning in the pursuit of profitable trading.

Ultimately, the key to thriving in day trading lies in maintaining a well-defined plan, managing risks effectively, and adapting to market conditions. By avoiding common pitfalls and embracing a disciplined approach, traders can increase their likelihood of achieving their financial goals and navigating the challenges of the market with confidence.

The Art of Geopolitical Risk Analysis: Enhancing Your Investment Strategy

Avoiding Common Day Trading Mistakes: Strategies for Success in the Stock Market

Dow Jones Utility Index as a Stock Market Timing Indicator

Velocity of Money Equation: A Holistic Perspective

Penny Stocks for Dummies: Embrace Courage and Ride the Waves

Exploring the Essence of Contrarian Thinking Review

The Impact of Contrarian Outlook Reviews

Exploration of collective behavior and Its Implications

Mass Formation Psychology: Understanding Collective Hypnosis

Stock Market Basics

Semiconductor Industry News