Penny Stocks for Dummies – introduction

Ignore the Noise; we’ll explore this further as we go along. Responding to the requests of numerous readers, we present a comprehensive guide on Penny Stocks for Dummies. Although we plan to create a downloadable PDF guide in the future, let’s make the most of this page for now.

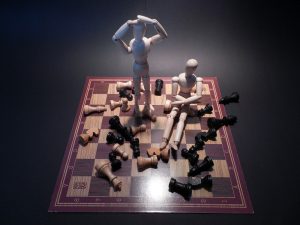

In this article, we’ll delve into some of the most common blunders made by inexperienced investors and sometimes even by self-proclaimed experts. Novice market participants often confuse stock market trading with true stock market investing. Additionally, there are those who misunderstand long-term investing and mistakenly adopt a flawed ‘buy and hold’ approach, which we might as well call ‘buy and fold.’ This error has plagued investors throughout history. Understanding the right time to buy, hold, or exit is crucial.

Penny Stocks for Dummies Guideline No. 2: The savvy investor seeks out trends and enters early into the direction, riding the wave until its culmination. Acquiring the basics of trend analysis proves invaluable in identifying the initiation of a new trend. Now, let’s circle back to the subject of Trading versus Investing.

Stock market traders aim for rapid, short-term profits, striving to extract maximum gains from stocks, options, futures, and the like. While this is the premise of trading, the unfortunate reality is that most traders end up losing more often than winning, and even their victories are usually overshadowed by long-term investors.

A few traders manage to excel, falling into the coveted 2% category of exceptional players. Their profits can be extraordinary, but for the majority, losses become the norm. On the other hand, the intelligent investor seeks out emerging trends, attempting to enter the market at the very beginning, often when it’s stabilizing after a sideways movement, indicating that the worst is likely behind.

Penny Stocks for Dummies Guideline 3: Distinguish Long-Term Investing from Buy & Hold Another prevalent mistake is confusing long-term investing with the misleading ‘buy and hold’ strategy. True long-term investing involves entering early and exiting when the trend concludes. A classic example lies in the 1990s Internet boom.

The right time to buy was in 1995 and 1996, with the time to sell being late 1999 and early 2000 when many Internet stocks violated their main uptrend lines. Those who bought into the ‘buy-and-hold’ myth found themselves poorer than when they first invested in these stocks.

A more recent instance was the housing market collapse and mortgage crisis that rattled the financial sector and caused a significant crash. The opportune time to invest in housing was between 1999 and 2006. While the market might have overshot for a while, buying after 2006 proved unwise. From that point on, the shrewd player was selling when the market was strong, resulting in minimal exposure to real estate by 2007.

Trend Analysis & Behavioral Economics We advised our subscribers to exit the housing market well before it reached its peak. The same principle applies to the internet bubble. Similarly, we guided our subscribers into the commodity bull market long before it boomed. For example, we closed out our Silver positions for gains of over 1000% and achieved gains of over 700% in Gold and Palladium positions.

We’re referring solely to Bullion gains, not the profits we made from numerous stock positions. To this end, we’ve developed an advanced tool that could have led to even more substantial gains had we implemented it earlier.

Penny Stocks for Dummies Tip: A fundamental concept aspiring stock market participants should grasp is the art of contrarian investing. In essence, a contrarian investor acts contrary to the prevailing sentiment. At Tactical Investor, we are renowned for adopting contrarian views based on Behavioral Economics. Emotions play a significant role in driving the markets, making Mass Psychology an essential factor. Admittedly, even contrarians sometimes find our perspectives hard to digest.

Penny Stocks for Dummies Guideline 4: Mastering Portfolio Management Portfolio management distinguishes market winners from market losers. It is an area often overlooked but incredibly vital when it comes to investing. Many traders and investors, who could have otherwise achieved success, end up losing year after year.

Avoiding these common stock investment pitfalls can save you a fortune, so take the time to devise a solid plan. It could be the difference between hitting a home run or losing your home.

Please note that this article is intended for educational purposes only, and it’s essential to conduct thorough research and seek professional advice before making any investment decisions.

Examining the Mild Impact of COVID-19 on the Younger Population: Penny Stocks for Dummies

Let’s take note of the relatively mild impact on individuals under 50, assuming a 1.3% infection rate. However, no information is provided about pre-existing conditions among these individuals. The data seems to be manipulated to project a specific outcome onto the public. A more comprehensive approach would involve listing any other health conditions the patients might have had before contracting the virus.

When we observe data from countries with robust healthcare systems such as Japan, Germany, Denmark, South Korea, Switzerland, and Singapore, the overall death rate appears to be remarkably low. In many cases, it is below one percent or well below 1.5% for all age groups. For instance, Singapore has reported zero deaths, and Taiwan has recorded only one.

The Manipulative Role of the Media

The media often presents theories without offering all the necessary data, and upon closer examination of articles, experts tend to use words like “may,” “could,” and “might.” Despite this, the general public tends to treat these speculations as undeniable facts.

Searching for direct answers about the relationship between COVID-19 and the flu on Google’s top 10 results yields numerous articles emphasizing the dangers of the new coronavirus variant. It seems that these articles may have been prioritized over time, while potentially more informative articles have been relegated to lower-ranking pages, receiving less attention. The truth is that COVID-19 is indeed from the same family as the flu but possesses more aggressive characteristics.

Unraveling Media Influence on Search Results

Even after examining six pages of search results on Google, finding a straightforward answer about the coronavirus’s connection to influenza was challenging. Resorting to an alternative search engine, duckduckgo.com, finally led to relevant information on the first page. However, even in that article, one had to scroll down to uncover the following information:

The CDC acknowledges that human coronaviruses are prevalent worldwide, including seven known types, some of which cause common colds. Nevertheless, two recent types, MERS-CoV and SARS-CoV, are linked to severe illnesses, as explained by Dr. Amesh A. Adalja, an infectious disease expert and senior scholar at the Johns Hopkins Center for Health Security.

The reason why the most popular search engine fails to provide a direct answer in its top 10 results is the overwhelming presence of opinion-based articles from high-ranking media sites. These articles have displaced potentially informative pieces from lower-ranking sites that could have provided a straightforward response. Most individuals typically stop at the first page of search results, making it unlikely for them to sift through data pages to find the answer.

The Golden Opportunity: Penny Stocks for Dummies

Amidst the March 2020 stock market outlook, we witnessed central bankers, especially the Fed, striving to bring interest rates towards zero. The recent 150 basis point rate cut prompted mixed reactions, with some labeling it as reckless while others call for further action. It seems that creating distractions and offering more drastic solutions can sway the masses to agree with the proposed course of action.

With the system infused with abundant liquidity, accurate media reporting could lead to markets soaring upwards. The mortality rate discussion overlooks that older individuals with pre-existing conditions are at higher risk. The near-zero interest rates coupled with increased money circulation due to Federal Reserve actions could lead to a significant rise in speculative investments, particularly in dividend-paying stocks.

As the Federal Reserve injects massive sums into the market, creating an ultra-low rate environment, the stage is set for unprecedented share buyback programs. Amidst pandemic-induced hysteria, an opportunity arises for astute investors, with long-term investors considering this a generational buying opportunity.

The current sell-off in the markets is based on assumptions and hysteria, paving the way for a unique chance for investors. The sentiment data analysis indicates the potential for a “father of all opportunities,” which may occur once in a lifetime. While short-term uncertainty persists, the landscape looks promising for banking substantial profits.

As panic subsides, a feeding frenzy will likely occur, driven by zero rates, multi-trillion-dollar injections from the Fed, and economic stimulus packages. This combination could lead to market surges of unimaginable heights, especially when individuals on fixed incomes turn to speculation, adding more cash to the markets.

In conclusion, amidst the market shifts and uncertainties, the penny stocks for dummies may be the golden ticket to capitalize on the impending market opportunities.

Unlocking the Secrets of Penny Stocks for Dummies

Amidst the prevailing bullishness and hysteria among the masses, history teaches us a valuable lesson: the best time to seize an opportunity is when chaos surrounds the crowd. We now stand at the brink of a generational buying opportunity, one that those who hesitate will come to regret for decades to come.

Key Takeaways:

- Embrace the trend in penny stocks for dummies, disregarding fear in your investing journey.

- The current market conditions create an unprecedented chance for long-term gains.

- The coronavirus pandemic paved the way for the Federal Reserve to inject liquidity and push interest rates to rock bottom.

- Be prepared for share buyback programs like never before, driven by the ultra-low rate environment.

- Remember that historical market patterns often witness states of euphoria before market tops.

- Savvy investors recognize the extraordinary potential behind the current hysteria-based selling.

- Adopting contrarian views and utilizing trend analysis can be the keys to success in penny stocks for dummies.

- A well-managed portfolio is paramount for sustained success in the stock market.

In essence, the current market conditions, borne out of the coronavirus pandemic, have created an unparalleled opportunity for penny stocks for dummies. Embracing a blend of mass psychology and technical analysis can offer valuable insights into market trends and guide your investment strategy. Moreover, incorporating the principles of contrarian investing, along with wisdom from the crowd and technical analysis, can elevate your trading skills. Keeping a comprehensive trading journal becomes essential in understanding your mindset and developing a strong battle plan to face any challenges that come your way.

Elevate your stock market performance with the power of understanding market psychology and applying astute investment strategies. Seize the generational buying opportunity presented by the current market landscape in penny stocks for dummies.

Other Articles of Interest

The Art of Geopolitical Risk Analysis: Enhancing Your Investment Strategy

Avoiding Common Day Trading Mistakes: Strategies for Success in the Stock Market

Dow Jones Utility Index as a Stock Market Timing Indicator

Velocity of Money Equation: A Holistic Perspective

Penny Stocks for Dummies: Embrace Courage and Ride the Waves

Exploring the Essence of Contrarian Thinking Review

The Impact of Contrarian Outlook Reviews

Exploration of collective behavior and Its Implications

Mass Formation Psychology: Understanding Collective Hypnosis

Stock Market Basics

Semiconductor Industry News