Americans Are Scared Of Investing and the question is why

The answer to this question is simple; the focus on the wrong factors such as news which is akin to gossip, political rhetoric, advice from experts (more like jackasses) and a plethora of other equally meaningless reasons. Let’s look at some of these factors individually. We will repeat this again, but the key to all this is understanding the key concepts of Mass Psychology; the most important of which is that one should never allow one’s emotions to do the talking.

From a psychological perspective, polarisation is a positive development as long as the trend is up. When people are driven by emotions (especially people in power), they cannot think clearly, and their only ambition is to destroy their opponent.

When one cannot think clearly, one is destined to lose the war; it is just a matter of time. Those that can remain calm in such periods usually stand to walk away with the most significant gains. Individuals from both parties will be going for the jugular, and some of these attacks will temporarily shock the markets. At the Tactical Investor, we embrace shock type events (as long as the trend is up) and the stronger the deviation, the better the opportunity.

Focusing on the Fear Factor Will Always Lead To Losses

Therefore, do not focus on the fear factor, but try to direct your attention to the “opportunity factor” if another shock type event hits the markets. The trend is up and showing no signs of weakening. Therefore we must treat anything the media attempts to market as a disaster, as an opportunity factor. The media is an extension of the mass mindset. For any con, you need at least two elements, a con artist and a bunch of idiots. An observer is not part of this equation for he/she does not equate with the conman or the idiot, the observers function is to observe, and then use the data to plot the most favourable path.

Take this as an early warning that should the media jackasses start pushing another B.S story, instead of panicking, one should break out of a bottle of champagne, and as the masses panic calmly sip on that champagne and build a list of strong stocks one always wanted to purchase. For those allergic to work, the option is simple; sit back and relax, for we always view stock market crashes as opportune moments when the trend is positive.

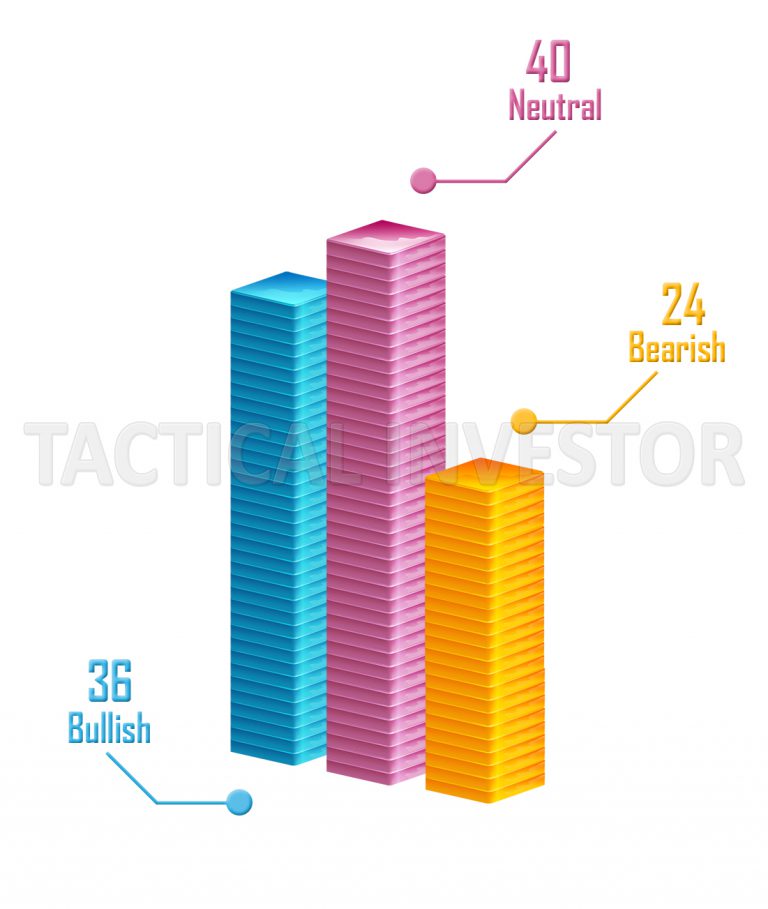

The masses are still too nervous for this Stock Market Bull To Die

Looking at the data above, the most compelling piece of information is the number of individuals in the neutral camp has not declined significantly and when you combine the number of individuals in the bearish camp, the total still adds up to 62. The” toothless wonders” of the world still outnumber the bulls, and that is a very bullish factor. Let us not forget that the masses are still sitting on a vast pile of cash; they are waiting for better times to buy, having forgotten that the best time to buy just eclipsed them about a month ago.

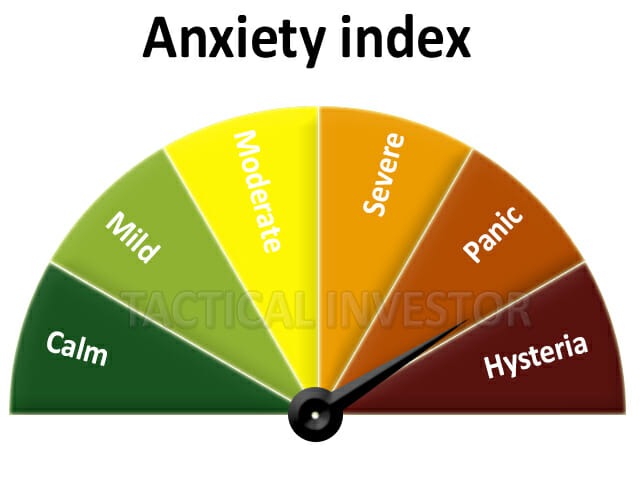

These sagacious men will once again buy close to the next stop and then wonder why their gameplan did not lead to a positive outcome. The best time to buy is when the masses are in panic mode, and when one feels far from certain about the future of the markets; certainty is the secret word for failure when it comes to the stock markets.

This bull market is unlike any other; before 2009, one could have relied on extensive technical studies to more or less call the top of a market give or take a few months; after 2009, the game plan changed and 99% of these traders/experts failed to factor this into the equation. Technical analysis as a standalone tool would not work as well as did before 2009 and in many cases would lead to a faulty conclusion. Long story short, there are still too many people pessimistic (experts, your average Joes and everything in between) and until they start to embrace this market, most pullbacks ranging from mild to wild will falsely be mistaken for the big one. Market Update Feb 28, 2019

Never Allow Fear To Take Over

One should remember this paragraph every time the urge to panic starts to rise; no bull market has ever ended on a note of fear or anxiety. Despite the media trying to create a new narrative to prove otherwise for the past several years; they have failed miserably, proving that news, in general, should either be treated as rubbish or viewed through a humorous lens. Americans fear all the things they should not & embrace nonsense which they should ignore

Random Views on Why Americans Are Scared Of Investing

Millennials are afraid to invest in the stock market

“New survey data suggests the ‘Someday Scaries’ could be” a factor holding young people back, Ally reports. About 61 percent of adults say they find investing in the stock market “scary or intimidating.” And millennials feel significantly more intimidated than Baby Boomers or those in Generation X, it says.

“The way to mitigate risk is through diversification. Investors should look at investing offers that provide a diversified portfolio with a balance based on their overall investing goals. In general, a portfolio that contains a variety of ETFs, bonds and cash is a great place to start,” he says.

“Start with a savings account that will give you a competitive rate of return and pay yourself first by putting whatever you can, even if it’s just a small amount, from each paycheck into that savings account.

“History has proven again and again that the key to achieving financial security is to start saving and investing early,” he says. “What people need most is to face the ‘Someday Scaries’ head on and get started, taking one small step at a time.” Full Story

People Are Still Scared of Investing

Only about 4 in 10 Americans and only 1 in 3 Millennials have money in the stock market. The most common justification – that those who don’t invest simply don’t have the money – doesn’t cover all the bases.

What governs the behaviour of those who have the money and choose not to invest in fear.

To a seasoned market participant, the fact that everyone with the means to invest doesn’t invest is baffling, but the implications are far direr than just missed opportunities.

Many Americans’ financial futures are uncertain, not because they don’t have the money, but because they don’t know what to do with it. Innovations and market events of the last decade haven’t dramatically improved financial literacy or investor confidence either. Full Story

Here’s why some Americans can’t invest in the market

For the rest of us, pay remains stagnant, with recent — and not exactly robust — nominal gains being erased by inflation. At the same time, life can feel increasingly unaffordable. Child care is staggeringly expensive, while the percentage of Americans with employer-provided health insurance who need to meet a four-figure deductible is rising rapidly, no doubt a factor in why one of three campaigns on the depressingly omnipresent GoFundMe is medical fundraisers. Four out of ten people say they couldn’t come up with $400 in an emergency. Consumer sentiment is falling even as retail sales increase. New business formation is falling dramatically. The government safety net continues to deteriorate.

Finally, too many are dependent on the markets for their retirements. Few workers outside of government employees currently enjoy access to pensions, with the result being that they are bound to use 401(k)s and Individual Retirement Accounts to attempt to provide for their post-work lives. The money in these accounts is mostly invested in the stock market. Even if the amounts in question are not exactly riches (half of those invested in the stock market have a sum total of $40,000 or less in play), it is enough to create a palpable sense of fear among many anytime the stock market indexes swoon — a “heads I don’t win, tails I lose” situation. Full Story

Survey finds that Many Americans Afraid of Investing

More than 1 in 3 Americans surveyed are afraid of investing. 43% of females surveyed are afraid of investing in the stock market compared to 31% of males, according to a new CreditDonkey.com survey

Fear of the unknown will stop most anyone in their tracks, even if a potential reward awaits them. In a new survey of more than 1,200 Americans by CreditDonkey.com, 46% of respondents revealed they are afraid of death and 37% of respondents said they are afraid of investing in the stock market.

Some 73% feel investing in the stock market is gambling while 31% think the stock market is rigged.

“It’s almost never profitable,” one respondent wrote. “The chances you’ll profit are the same as scratching a lottery ticket.”

Another respondent claimed the market is “rigged to benefit those already in power, the elite 1%.” Full Story

Follow the Trend and ignore the noise for the trend is all that matters, the rest is rubbish

Courtesy of Tactical Investor