While Experts Panic Tactical Investor states Stock Market Crashes and Bear Markets are Buying opportunities

We decided to apply the simple concept of pricing the Dow in Gold and Silver in the same way we did in an article titled Dow 1200 Illusion or? We will take the low of the Dow in the last four years and the low that gold put in the last four years. As the Dow is priced in Dollars, we will divide the price of gold into the Dow. For the record, we could choose other price points as they only serve to illustrate our point.

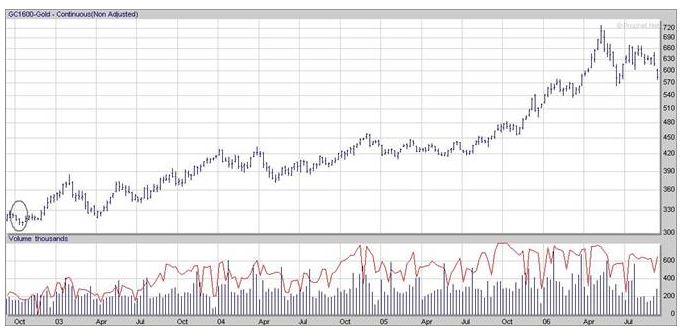

In Oct 2002 the Dow was trading at 7200 (4-year chart), and Gold was trading roughly around 300.

Dow

Gold

If we divide 7200 by 300 (the price of Gold), we get 24 ounces. Now it took 24 ounces of Gold to buy the Dow back in Oct 2002 (remember we taking the Dow’s lows into consideration and not it’s highs) so it should take at least 24 ounces or more to buy the Dow today. Let’s check that figure out.In May of this year, the Dow put in a new 52 week high and almost tested its old all-time high of roughly 11700. For argument’s sake, we will assume that the Dow traded to 11700 in May. At that time Gold put in a high of roughly 720.

11700 divide by 720 = 16.25

Back in 0ct 2002, it took 24 ounces to buy the Dow and at this time it was trading at a four-year low. This means that the Dow was trading higher back in Oct 2002 then it was today because today it takes 8 ounces less of Gold to buy the Dow when it’s trading at close to a new five years high. For the Dow just to break even to its Oct 2002 levels it would have to be at (24 X 720) 17280.

The Dow only made it to 11700 so far. That mean the Dow has corrected over 35% as it should be at 17280 instead it’s below 11700. Market technicians state that we are in a bear market if the market has corrected over 20%. Based on these figures we have corrected over 35%, yet the Dow has just put in a series of new illusory 52 week highs. Hence, in reality, the market could technically rally a lot more and still be in a bear market. The funny part is that the bears are right, but they just don’t know how to use this info, and the bulls are wrong, but they happen to use the info for the time being in the right manner.

You might also find this related article to be of interest: Should you fear Stock Market Crashes

If we use Silver as the constant, the figure we get is even more outrageous, and it suggests that the markets have corrected even more than 35%.

Silver was trading around the 5.15 mark in Oct 2002.

Dow 7200 divided by 5.15 = 1398 ounces

May 06 Silver traded roughly to 15 dollars

1398 X 15= 20970; that’s the level the Dow should be just to equal the level it was trading in Oct 2002 when priced in silver.

This means that the Dow has already corrected a whopping 44.2%, and yet it has put in a series of new 52 week highs. These highs are all illusory in nature.

Since the Dow is priced in dollars lets, perform a final test on the Dow. The Dow hit an all-time high back in 2000 (look at the picture below). To simplify matters, let’s assume the value of this high was 11700 (actually it’s higher).

Now let’s look at what the dollar was doing in the same period. At the time the Dow put in it’s all time high the dollar index was trading around 105; this is roughly 20 points (currently in the 85 ranges) lower than where it’s trading right now. On a % basis, it works out to 19.5%. To make things simple, we will round it off to 20. That means the in today’s dollars the Dow would have to trade 20% higher than the high it put back in 2000 just to break even. At this point, the chances of the Dow trading to the 14040 price point level are slim to none. If we were wildly optimistic we would probably issue a target of 12600 at the most; for the record, we are not wildly optimistic at this point.

Conclusion; forget the noise and focus on the trend

This is yet another completely out of the box way of examining the markets and what they are doing. This viewpoint provides yet another valid reason to support our bullish outlook on the intermediate time frames. We are still bearish when taking the long-term view. However, a lot can happen between the short, intermediate and long time frames. If you are not correctly positioned, you could end up bankrupt while being right.

One could technically state that the market is only experiencing a long dead cat’s bounce or that we are in a long-term bear that is truly invisible for the time being. In the end, one must understand that when one is dealing with the markets that nothing remains the same forever; those who examine the markets with closed eyes and a closed mindset will find that their wallets enter into the empty rather rapidly. This little exercise also very clearly illustrates the evils of inflation.

Since we can’t know what knowledge will be most needed in the future, it is senseless to try to teach it in advance. Instead, we should try to turn out people who love learning so much and learn so well that they will be able to learn whatever needs to be learned. John Holt 1908-1967, Australian Politician, Prime Minister

Final note

Please remember we are just offering another possible way of looking at the Dow. Do not only jump on the super bullish bandwagon and assume that the Dow is going to keep soaring upwards forever.

Charts were provided courtesy of prophet finance

Additional Suggestions

If you seek freedom, the 1st task is to attain financial freedom so that you can break free the clutches of the top players who seek to enslave you. They want you to run in a circle like a hamster that runs on a spinning wheel; the hamster thinks the faster it runs the further it will go, but sadly it is going nowhere.

We teach how to use Mass psychology to your advantage, how to view disasters as opportunities and how not to let the media manipulate you and direct you towards actions that could be detrimental to your overall well-being. Visit the investing for dummies section of our website; it contains a plethora of free resources and covers the most important aspects of mass psychology.

Secondly, subscribe to our free newsletter to keep abreast of the latest developments. Change begins now and not tomorrow, for tomorrow never comes. Understand that nothing will change if you don’t alter your perspective and change your mindset. If you cling to the mass mindset, the top players will continue to fleece you; the choice is yours; resist and break free or sit down and do nothing.