Trading is all about Volatility: the Media is all about hoax

Market crash and Media Hoax: Volatility readings have shot to a new high; 2018 has been a very active year as far as this indicator goes. This indicator has provided and continues to provide (advance) warning that traders should be prepared to deal with a more volatile market. Volatility is a terrible thing, only if one allows one’s emotions to do the talking; otherwise, it should be viewed through a positive lens as it keeps the masses uncertain.

On Monday (Dec 24), we had the worst Christmas Eve session in history. On Wednesday, another milestone was achieved; the Dow experienced its largest one day point gain ever. On Thursday, we set another record; the markets experienced the largest intraday reversal in over ten years. Such moves confirm uncertainty is at the helm and bull markets have never ended on a note of uncertainty.

There are certain things that it’s fairly easy to predict far in advance, because they happen with routine regularity: The sun will rise in the morning, Christmas will be held on December 25, the Detroit Lions will not win the Super Bowl.

But there’s a difference between those certainties and trying to claim any real confidence about events that are by and large impossible to know in advance: what cultural issues will be salient political topics next year, what non-Mueller subject will President Donald Trump fulminate about on Twitter tomorrow.

And yet, in an age of social media, everybody is now a pundit—which is not a bad thing, but often takes the shape of overconfident prognostications that are more often wishes about what we hope happens rather than thoughtful analyses of what will.

As 2018 draws to a close and we again turn our thoughts to the new year, POLITICO Magazine brings you its fifth annual “worst predictions” list, reflecting on the gulf between what actually happened this year and what some people were so sure would.

Extreme Uncertainty should be viewed through a bullish lens

This market is not only experiencing an extended bout of volatility, but it is going through a bipolar phase as politics is being used as a weapon to move the markets. Without getting into details, politics (as politics, unless it’s related to the markets, is beyond the scope of this publication) is being used in a wicked manner to turn the masses on each other and to whip the markets. Whether you love or hate Trump, one thing stands out like a sore thumb; the media have never attacked a sitting president in such an aggressive manner. Trump has probably been attacked more than the last four presidents combined. Indirectly, this is having a significant impact on the markets.

Emotions drive stock markets

If you drive the masses insane with the rage, the driving force behind the markets change. Now you have a rage/frustration factor to add to the equation. The press has decided to turn regular politics into a weapon of mass destruction. Every single, stupid, meaningless event is turned into some political story. Today’s reporters are akin to prostitutes who will do the bidding of the highest bidder. Most of them would be perfect candidates for electric shock therapy, for only a severely disturbed person could hold a straight face while falsely pushing out stories under the guise of news when at best they would fall under the category of C**P.

We are not only talking about the events that are occurring in the US but all over the world. For example, look at the way the press and the elites are going out of their way to subvert the will of the people regarding Brexit by using every dirty trick in the book. They are falsely laying out stories that border on the surreal regarding the fallout Britain will suffer if it leaves the EU; these stories are rubbish, and in the long run, Britain would thrive by ridding itself of the shackles the EU has imposed on it. This tactic of mixing economics with politics to create uncertainty in the markets is being used quite ruthlessly. However, it is a deviation of the same old con; get the masses to dump quality shares at rock bottom prices.

When Emotions Talk, The Money Walks

Bear in mind we are examining the data from a trend perspective and not an emotional perspective. It is the press that is willfully weaponizing the news and going out its way to sow the seeds of division, and in doing so, they have created so much angst and uncertainty, that these emotions finally found their way into the markets. One day the significant correction of 2018 will be used as an example to illustrate how an out of control press went out of its way to print rubbish instead of facts, in order to manipulate the perceptions of the masses.

We went on record to state that if Trump won the elections, that from an investment perspective it would be a fantastic development for the markets. Moreover, these statements were made before he was declared the winner. After he won the election, we went on record to state that the political landscape would resemble a soap opera on steroids.

If you want to rob a man without resistance, then all you need to do is make him focus on an issue that makes his blood boil. That is what is going now; the masses are being given two main options, both of which lead to unfavorable outcomes. We expect the attacks on Trump to surge to even higher levels, but from nowhere the resistance will suddenly coalesce and mount a counter attack. However, this was the grand plan all along; conquer via division.

Now as the masses are inflamed and filled with rage, laws will be passed that will make it insanely easier for corporations especially banks to rob them. Never allow emotions to drive the decision-making process; the outcome is always bad in the long run.

Since bottoming in March 2009 the stock market has seen plenty of pullbacks (5% to 9.9% declines) and corrections. In 2011 we even came within a stone’s throw of an actual bear market. Each correction is associated with its own market fears, specifically obsessing over risks to the economic and earnings fundamentals that ultimately determine share prices.

In 2011 it was fears over the European Sovereign debt crisis and the US debt ceiling showdown (US lost its AAA credit rating from S&P) that was supposed to plunge the world back into recession and send earnings tanking. In 2015 (a year which saw two corrections) it was fears over China’s slowing growth, rising interest rates, and crashing oil prices (sound familiar?)

https://www.youtube.com/watch?v=a-xpKMfsyWM

Now the market’s “wall of worry” is once more about Fed rate hikes, slowing growth (due to the trade war which is likely to end by February) and overall slowing global growth rates (plus a yield curve inversion in the US). But guess what? The stock market has generated 9.2% CAGR total returns since 1871 through far worse events than these current risks. We’ve suffered depressions, World Wars, killer flu pandemics (1918 Spanish flu killed 5% of the world’s population), and numerous recessions and financial crises. Unless you think the world is literally going to end it’s almost certain that the stock market will be higher over the next five to 15 years.

Bears are out in full force, claiming that the world is coming to an end.

Now think about this; How many perma-bears are rich? The truth is that most perma-bears have been bankrupted several times over. Bull markets last longer than bear markets, and the returns are significantly higher.

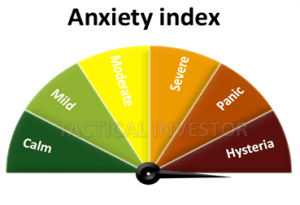

Despite the rally, the gauge on anxiety index is still trading outside the extreme of extreme zones and bearish sentiment increased by another two points. Individuals from the neutral camp migrated towards the bullish and bearish camps. Bearish sentiment is very close to surging to a seven-year high. A move to the 57 ranges would achieve this feat.

Insiders are on a massive buying spree

Insider buying has surged to an eight-year high. These guys have insights into their companies, and if the markets were going to fall apart, they would not be investing their cash into a dying asset.

The number of corporate executives and officers scooping up shares of their own companies has doubled in the past two months from the prior two. As a result, insider buyers are outpacing sellers by the most since August 2011, data compiled by The Washington Service showed.

“Insiders are pretty well informed at the micro level of their businesses,” Todd Fungard, who oversee $1.2 billion as chief investment officer of McQueen, Ball & Associates Inc., said by phone. “It’s a good sign that business leaders still see demand at their companies and feel comfortable buying their own stock despite the headline risk.”

The last time insider buying spiked in this fashion, in August 2011, the S&P 500 was in the middle of a 19 percent retreat before staging a 10 percent rally in each of the next two quarters. Full Story

Courtesy of Tactical Investor