Strangely and (possibly) sadly, bonds and the equities markets seem to be paying no heed to the ever-growing debt, which has just surpassed the $22 trillion mark.

US Debt To GDP; Is Anyone Paying Attention To It

Bonds are looking for any reason to mount a long term rally, after being held hostage to the Fake threat of inflation. A very desperate Fed t is trying to maintain the illusion that the USD is the strongest currency in the world. This was achieved by shoring up interest rates even though the data (yes we know its manipulated but since it has been always been manipulated it should be used fairly in raising and lowering rates) since the onset has indicated that inflation is a non-event.

The Fed appears to be operating like an insane person that is convinced his left toe is talking to him. However, most central bankers are not taking the same path, and some emerging nations are only raising rates because they are being forced to in order to defend their currency against a stronger dollar.

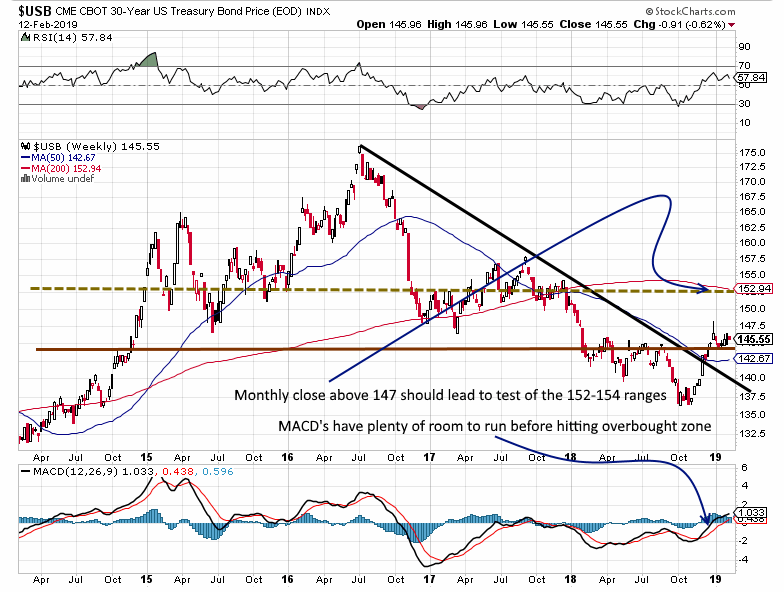

A monthly close above 147 will most likely push bonds to the 152-154 ranges with an overshoot as high as 159.00. The long term outlook for interest rates is negative; in other words, rates are heading lower and savers are going to be punished again.

Global Currency War

When the Fed started its rate hiking program we stated in our view the premise behind this move was to make the US dollar the most attractive currency in the world in the midst of the global currency war that has been taking place for over a decade. In this race to the bottom, the idea is to finish last. The US continues to rack up huge debts, and in order to continue doing this, it is currency has to look attractive.

When it starts to lower rates again and it will be forced to do so, it will be starting from a very high point, and as it lowers rates, other developed nations will be forced to follow suit; you ask why? Nations want to have a competitive advantage when it comes to exports. China and Germany understand that better than most nations.

Germany abuses the EU

Germany has in essence been abusing the EU via the Euro: it has found a way to raise its exports to levels it would never have been in a position to do so under the German Mark. If it were using the “Mark“, it is currency would be 20% higher and its exports would be nowhere near current levels. So it seems that US Debt To GDP ratio is something nobody cares about or no one is paying attention too; at least that is what the top players appear to be doing.

For the astute investor that is paying attention to the US Debt To GDP ratio, the best way to protect your assests is to view stock market crashes as buying opportunities. Until fiat is eliminated the Fed will always intervene and prop the market up again and therefore market crashes provide the smart player with a chance to purchase top rated companies at a huge discount.

Why the US can afford a stronger currency

The US is not an export-dependent market so it can afford to have a currency that is valued slightly higher, than most. As the US will be starting from an advantageous position, it is currency will still be attractive relative to other major currencies, even when it starts to lower rates. Most nations economies are export dependent so as the US lowers rates they will be forced to do so in kind, which effectively means that the USD will maintain its position as one of the most attractive currencies out there. It is a splendid plan, but the Fed has to be careful that it does not overplay its hand.

As we stated not too long ago, worldwide debt is soaring; in 2017 it stood at $233 trillion. So what is another trillion here or there; it is already so high that collectively the world’s nations will never be in a position to pay it back.

BOE all Bark and no Bite

The BOE would not be making statements that amount to the ramblings of an insane person if everything was going according to plan; they keep hinting that they are going to raise rates again, but the August rate hike could end up being the last, and they might be forced to make a U-turn. The Brexit chaos has already affected economic activity in Britain, and the once robust housing sector is grinding to a halt. House sales fell to their weakest level in five years. The BOE would have to be extremely daft to raise rates in such an environment.

EU playing game of Cat and Mouse

They have done nothing. One minute they state they are ready to raise rates, the next minute they cite new issues that call for more caution. Here is the latest from Draghi:

“We need to monitor these trade risks very carefully over the coming months,” Draghi said. “However, we still see the overall risks to the growth outlook as broadly balanced, in large part because the underlying drivers of domestic demand remain in place.” Full story

In other words, Draghi is saying; we will state that there is a need for a rate hike, but we will not do anything about it because the outlook is quite terrible

Japan, on the other hand, cannot afford a very strong currency

The Boj hs continued to huff and puff but other than that they have done nothing and it will be hard pressed to do anything. Interest rates were left untouched at -0.1% citing

The central bank also revised down inflation forecasts again, saying that the momentum toward achieving the price stability target of 2 percent is not sufficiently firm despite years of massive monetary easing. Interest Rate in Japan averaged 2.81 percent from 1972 until 2018, reaching an all time high of 9 percent in December of 1973 and a record low of -0.10 percent in January of 2016.

The inflation forecast for the fiscal year ending March 2019 was lowered to 0.9 percent from 1.1 percent previously estimated. Also, the central bank now expects inflation to average 1.4 percent for fiscal 2019 (vs 1.5 percent) and 1.5 percent for fiscal 2020 (vs 1.6 percent). Full Story

Interesting development on the weekly and Monthly charts

We have a very interesting development; under normal circumstances when the weekly and monthly charts are trading in the oversold ranges, the ensuing move up is almost always huge. Utilities typically don’t fare well in a rising rate environment, but the MACD’s on the Monthly charts of the Dow utilities are also very close to experiencing a bullish crossover; we have several strong factors indicating that rates should drift lower. The only thing that could delay this trend is a stubborn Fed. Mass psychology states that one should focus on investments that the masses are either ignoring or unaware off. Hardly anyone is aware of the stealth bull market that is taking place in the bond arena.

Courtesy of Tactical Investor

Random views on USA Debt To GDP

The National Debt Explained

The national debt level of the United States is a measure of how much the U.S. government owes its creditors. Since the government almost always spends more than it takes in, the national debt continues to rise. As of January 3, 2019, the national debt stands at $21.974 trillion, according to the U.S. Treasury Dept. It has increased 10 percent since President Trump took office in January of 2017. Under President Obama, the national debt increased 100 percent, from $10 trillion to $20 trillion.

It is easy to understand why people (beyond politicians and economists) are starting to pay close attention to the issue these days. Unfortunately, the manner in which the debt level is explained to the public is usually pretty obscure. Couple this problem with the fact that many individuals do not understand how the national debt level affects their daily lives, and you have a centerpiece for discussion — and confusion.

National Debt vs. Budget Deficits

First, it’s important to understand what the difference is between the federal government’s annual budget deficit (or fiscal deficit) and the outstanding federal debt (or the national public debt, the official accounting term). Full Story

What Is the National Debt in 2019 and What Does It Actually Mean?

If there is one thing you take from this article, one single fact worth pulling out, it’s this: The national debt has no analogy to personal finances. There is absolutely no national credit card, no tab for some other nation to “call in,” each American does not “owe” $42,998.12.

It is a borderline disservice to our readers even linking to that last source because none of this exists. It’s fake, fantastical and make-believe. These ideas come from the fiscal version of Narnia, where economists do battle against rational hobgoblins wielding enchanted slide rules. If you ever find yourself comparing the national debt to a household checkbook, step back through the nearest wardrobe. Hard. Repeatedly.

Good. Now that’s out of the way.

Note: All numbers are accurate and current at time of writing.

What Is the National Debt?

The national debt is the full measure of currently issued government securities. When the government’s combined public and internal obligations exceed its total revenue, it issues securities such as bonds, notes and bills which add to the national debt.

The U.S. Gross National Debt is approximately $21.9 trillion. This debt comes in two forms: intra-governmental and public. Full Story

Why the $22 trillion national debt doesn’t matter – here’s what you should worry about instead

The U.S. federal government’s debt load hit another milestone this month: It’s now a record US$22 trillion in nominal terms.

That’s $67,000 for every man, woman and child living in the U.S., and it’s up $2 trillion since President Donald Trump took office in 2017. For comparison, U.S. debt is more than the total size of the United States’ $20 trillion economy and equivalent to the gross domestic products of China, Japan and Germany combined.

This hefty sum is a reflection of the large annual budget deficits that the federal government has run, pretty much continuously, since 1931. Prior to that, surpluses were much more common, apart from the years following the Civil War.

With another round of anxiety-causing debt-ceiling debates likely to return in the coming months, like other economists, I believe it is worth asking whether we should even care about the size of government debt.

Default isn’t imminent

First of all, it’s important to note current U.S. debt levels do not indicate any risk of imminent default.

As long as the U.S. federal government remains an “ongoing concern” – fiscal institutions are strong and effective, taxing authority is maintained and the long-run productive capacity of the nation’s economy is secure – there is no economic reason to fear default on the nation’s debt. Political reasons, such as debt-ceiling mischief, are another matter. Full Story