Mass Hysteria and the coronavirus

What is mass hysteria? A perfect example of the masses leaping before they look. in this instance, the crowd has not even bothered to examine the data closely. If they did they would have seen that the so-called experts are nothing but jackasses in disguise.

Long before this pandemic hit, we stated that central bankers, especially the Fed, was on a mission to take rates towards zero. Imagine if the Fed had lowered interest rates by 150 bases two weeks ago, how people would have reacted. When the Fed cut rates before the coronavirus attack, experts were quick to label them as being reckless, but now after a 150 basis point cut, they say more has to be done. Notice the ploy here; to do that which the masses abhor, one has to create a situation that distracts their attention. Then offer a solution that is three times as damaging as the previous one and in their desperation to seek safety, they will agree to whatever course of action is laid out.

The system is going to be flooded with so much liquidity that the markets will melt upwards when the media starts to report the data more accurately. Right now, they talk about the mortality rate without breaking the data down and informing the masses that older individuals are the ones that fall into the high-risk category. Even then, most of them appear to have some other complications already.

Updated mortality rate by age group and nothing much has changed

Notice how mild it is for those that are under 50, but let’s assume its 1.3%, no data is provided on whether these individuals had any existing conditions. So far, they are using stats to manipulate the data to suit whatever outcome they want to project onto the masses. A more robust approach (which would be relatively easy) would entail listing down any other conditions the patient might have had before becoming infected.

Furthermore, when you look at the data from countries that have sound health systems in place, the overall death rate is quite low. Take a look at Japan, Germany, Denmark, South Korea, Switzerland, Singapore, Taiwan, etc., the total death rate is well below 1.5 and in many cases below one per cent and that’s accounting for all age groups. For example, Singapore so far as has zero deaths, Taiwan only has one, and so on.

Mass Media Operating from an Alternate reality

The media is pushing theories without all the data, and if you read almost all the stories you will see experts using words, such as may, could, might, but the masses treat these opinions as facts. Try to google the term “is the Coronavirus from the same family as the flu virus: “You won’t find any articles that answer the question directly in the top 10 search results. Instead, you will find a plethora of articles that go on describe how dangerous the new variant of the Coronavirus is. These articles were there before, but now they have been pushed to the bottom pages where no one bothers to look at.

The answer is simple, yes, it’s from the same family, but it’s a more virulent version. After going through six pages of results, I could barely find a straight answer on Google that discussed only the Coronavirus as it relates to influenza. I had to use duckduckgo.com and only then was I able to find something of value on the first page, but after scrolling down the article in question was I able to find the following info:

Human coronavirus is pretty common throughout the world, according to the CDC. There are seven different types that scientists know of, and many of them cause colds, says infectious disease expert Amesh A. Adalja, M.D., senior scholar at the Johns Hopkins Center for Health Security. However, two newer types—MERS-CoV and SARS-CoV—can cause severe illness. http://bit.ly/2UeuVL5

So why can’t the most popular search engine provide an article in the top 10 results that will answer the question directly? The answer is due to high ranking media sites pushing an enormous amount of opinion based articles, that have replaced articles from lower ranking sites that would have answered the question. Most individuals are not going to sift through pages of data looking for the answer; they stop at the first page and usually look at the top results.

https://youtu.be/V8A0Ji5Cl9I

Mass Hysteria: Panic never leads to a positive outcome

This hysteria based sell-off is producing one of the most significant buying opportunities in decades, more on that later.

In the short-term technical analysis cannot identify support levels because we are dealing with madness, and that is the reason, we added the new standard in the anxiety index. What exacerbates the situation is that there is very little liquidity, look at the bid and ask price on some options they are unreal, for example, a bid of 1.40 and ask of 5.00. This provides a few big players with the opportunity to move the markets in whatever direction they see fit.

The only thing that can help stabilize the situation immediately will be one of the following

- The Fed throws the Kitchen and the Kitchen sink at this market and A huge Stimulus package is unveiled

- The press starts to accurately report the news; all they have to go is go to worldmeters.info to get a better take of what is going on

- A new rapid detection test is announced

- The US comes up with concrete measures to rapidly test a large number of individuals. This would be seen as good news because the average death rate is 1.39% and that’s taking all groups into consideration. This is significantly lower than in China and many other nations.

- A vaccine works in clinical trials. The FDA is going to approve the usage of this vaccine extremely fast, however, data has to show that it works even with limited trials.

- A treatment that has a 90% cure rate.,

Mass Hysteria in the markets serves as the foundation of the Next bull market.

when you add in stupidity and ineptitude by the elected officials, what should have been a mild situation turned into a nightmare type scenario. We are supposedly the most advanced nation on earth, but after the current debacle, one would be hard-pressed to call the US advanced at least when it comes to the medical arena.

What we know for sure, is that a vaccine and a better treatment will be found; it is just a matter of time. As for the press and politicians acting in a sensible manner that’s a hard call.

This chart from the 1940s clearly illustrates that every so-called crash has proved to be a buying opportunity and in the long run, bears are always killed, but the same cannot be said of bulls. Hence, when the trend is up and it is up right now, every strong correction has to be viewed through a bullish lens.

Mass Hysteria is A Contrarian Investor’s Best Friend

Still, the long term outlook is given, more so as this crash started on a note of uncertainty, unlike every previous market crash.

“the time to buy is when there’s blood in the streets.” Baron Rothschild

Losing your head in a crisis is a good way to become the crisis. – C.J. Redwine

Sooner or later comes a crisis in our affairs, and how we meet it determines our future happiness and success. Since the beginning of time, every form of life has been called upon to meet such crisis. – Robert Collier

Successful people recognise crisis as a time for change – from lesser to greater, smaller to bigger. – Edwin Louis Cole

It’s not always easy to do what’s not popular, but that’s where you make your money. Buy stocks that look bad to less careful investors and hang on until their real value is recognized. I’ve never bought a stock unless, in my view, it was on sale. Buy on the cannons and sell on the trumpets John Neff

In order to win as a contrarian, you need the right timing and you have to put on a position in the appropriate size. If you do it too small, it’s not meaningful. If you do it too big, you can get wiped out if your timing is slightly off. The process requires courage, commitment and an understanding of your own psychology Michael Steinhardt

I will tell you how to become rich…Be fearful when others are greedy. Be greedy when others are fearful. Warren Buffett

To succeed as a contrarian, you must recognize what the crowd believes, have concrete justification for why the majority is wrong, and have the patience and conviction to stick with what is, by definition, an unpopular bet. Whitney Tilson

Humans are prone to herd because it is always warmer and safer in the middle of the herd. Indeed, our brains are wired to make us social animals. We feel the pain of social exclusion in the same parts of the brain where we feel real physical pain. So being a contrarian is a little bit like having your arm broken on a regular basis. James Montier

There are many who give advice, but few that offer guidance. Anonymous

Our all-time favourite

To buy when others are despondently selling and to sell when others are euphorically buying takes the greatest courage, but provides the greatest profit. Bull markets are born in pessimism, grow on scepticism, mature on optimism and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell. If you want to have a better performance than the crowd, you must do things differently from the crowd. Sir John Templeton

Stock Market Outlook Going Forward

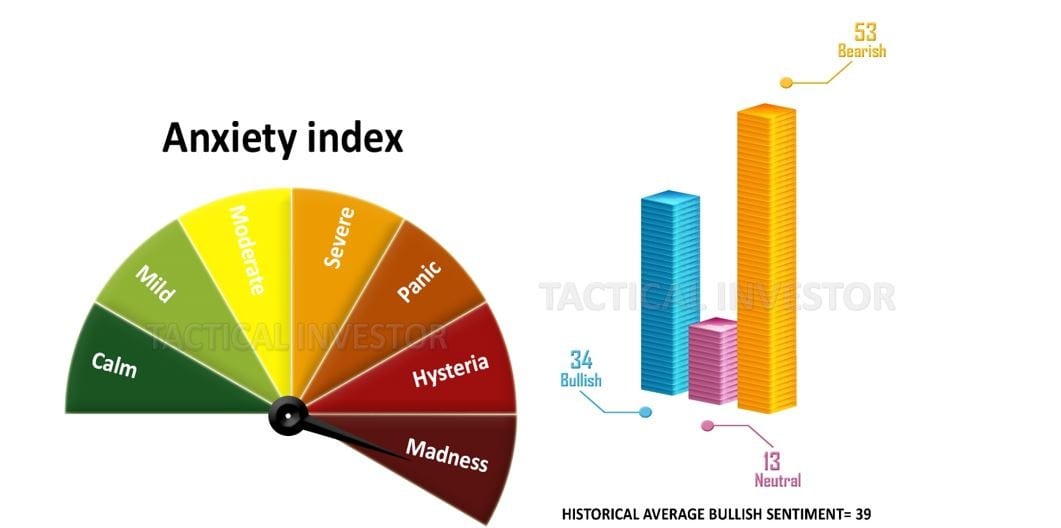

We have moved deeper into the madness zone, and neutral sentiment has dropped to levels not seen for years. It is trading at 13, but bullish sentiment while below its historical average is still quite high, it would be ideal for it to drop below 24. Bearish sentiment continues to trend higher, and that’s a good sign. As things stand right now, we are close to another “mother of all buy signals” that would match that of 1987 and 2008. Our indicators just need to dip slightly lower into the oversold range.

The trend as per our trend indicator is positive which suggest that every pullback ranging from mild to wild should be embraced.

Courtesy of Tactical Investor

Mass hysteria: An epidemic of the mind?

An outbreak of fatal dancing fits among members of the same community, men suddenly gripped by the sickening fear of losing their genital organs, and teenagers having mysterious symptoms after watching an episode of their favorite TV series — these are all instances of what we often refer to as “mass hysteria.”

“They danced together, ceaselessly, for hours or days, and in wild delirium, the dancers collapsed and fell to the ground exhausted, groaning and sighing as if in the agonies of death. When recuperated, they […] resumed their convulsive movements.”

This is a description of the epidemic of “dancing plague” or “dancing mania” as given by Benjamin Lee Gordon in Medieval and Renaissance Medicine.

These events were spontaneous outbursts of uncontrollable dancing motions that gripped people in communities across Europe in the Middle Ages.

Those affected would often reportedly be unable to stop dancing until they were so worn out and exhausted that they died. These events are typically cited as some of the first known instances of what would come to be referred to as “mass hysteria.”

Mass hysteria is a phrase that is used so often and so imprecisely to refer to anything from giving in to fashion fads to participating in riots and raves that it has become something of a fluid concept, synonymous with anything with a negative connotation that involves the participation of a large group of people. Full Story

The Mystery of Mass Hysteria

WEDNESDAY, Jan. 18, 2012 — A few months ago, six teenagers at LeRoy Junior-Senior High School in upstate New York began exhibiting tics and verbal outbursts that resembled some of the classic symptoms of Tourette syndrome. The students — all girls, of whom there are now a dozen — were shaking and jerking uncontrollably, sometimes to the point of not being able to speak.

Parents and school officials were understandably alarmed and launched a full-scale investigation to determine whether environmental substances in any of the buildings could have triggered the problem. Thus far, however, all reports have come back clean.

Now a doctor who is treating some of the girls has come forward with a surprising explanation: mass hysteria.

“It’s happened before, all around the world,” said Laszlo Mechtler, MD, the neurologist who diagnosed the teens. “It’s a rare phenomena.”

Mass Hysteria Throughout History

Not that rare, as it turns out. Mass hysteria — in which various people in a common group (such as students within a school) spontaneously exhibit an outbreak of physical symptoms caused by psychological stress — has been documented frequently over the ages, dating all the way back to the 14th century. In fact, according to a report from the Johns Hopkins University School of Hygiene and Public Health, there were at least 70 distinct outbreaks between 1973 and 1993 alone, 34 of which occurred in the United States. Schools, workplaces, and small communities were the most common settings of these events Full Story