Trending Stocks 2020: Before we get into the meat of the article, let’s look at some of the statements we made over the past few weeks. These comments are being extracted from the market update service.

Put your personal feelings aside and understand this simple fact. No bull market has ever ended on a note of fear; it has always ended on a note of extreme joy. Market Update Jan 17, 2020

Since the inception of mass media, the idea has been to stampede the crowd or create a feeling of euphoria and both conditions are deadly when it comes to investing. However, the new ploy is to keep the masses agitated constantly or uncertain. Why would they do this? When someone is uncertain it takes longer for them to cling to a given viewpoint; they keep jumping from one camp to another, and that is one of the reasons why this bull market has lasted so long.

A sharp pullback is still an outcome we view through a very bullish lens. The ideal setup calls for the Dow to trade to the 28,800 to 29,000 ranges, with a possible overshoot to 29,300. After that, a nice sharp pullback would set the bedrock for a surge to and possibly well past 30k. Market Update Dec 29, 2019

The best time to buy is when the masses are in a state of disarray, and this usually occurs when it looks like the markets are crashing. The masses are hardwired to view strong pullbacks as the start of a new crash, but most pullbacks are nothing but resting points; the markets use these stops to build up energy for the next upward leg. Tactical Investors should hope that the market’s pullback strongly, for it provides them with a lovely opportunity to open long positions at a discount.

It is also one of the reasons why in general the small player is still sitting on the sidelines. They still don’t know if they should jump in and buy or if shorting the markets is the right course of action; the longer they remain uncertain, the higher this market will trend. Market update Jan 7, 2020

One can immediately spot that the media takes delight in blowing anything out of proportion as it comes down to eyeballs and dollars. The more bombastic the headline, the more attention it will get, even if this attention is for a few minutes. In the end, we don’t have news today what we have is weaponized gossip.

Stock Trends and The Coronavirus Factor

The Coronavirus issue is going to be blown out of all proportions and it will be made to look like the mother of all pandemics. In fact, we are seeing individuals that are not qualified to make projections on the rate this virus will spread, stating that millions upon millions will be affected.

Now people are being checked with thermometers to see if their temp is above normal and an above-normal temperature has now become the litmus test for the Coronavirus; voodoo science at its best. This is one of the most retarded medical tests of all time, but no one seems to notice; a real-life depiction of “Pluto’s Allegory of the cave”.

CDC estimates that the burden of illness during the 2018–2019 season included an estimated 35.5 million people getting sick with influenza, 16.5 million people going to a health care provider for their illness, 490,600 hospitalizations, and 34,200 deaths from influenza (Table 1). The number of influenza-associated illnesses that occurred last season was similar to the estimated number of influenza-associated illnesses during the 2012–2013 influenza season when an estimated 34 million people had symptomatic influenza illness6. http://bit.ly/2UMJjMG

In comparison to the flu virus, the Coronavirus has caused a minimal amount of damage yet it has received 100X more coverage than the flu virus, which resulted in 34.200 deaths (and only US data is being used).

Worldwide, tobacco use causes more than 7 million deaths per year.2 If the pattern of smoking all over the globe doesn’t change, more than 8 million people a year will die from diseases related to tobacco use by 2030. http://bit.ly/2wcEl1s

Many of the masks that individuals are wearing are not that useful against viruses and even the masks that might provide protection need to be worn correctly. http://bit.ly/2HklQKB. Other experts state that masks are useless as the virus is spread through the eyes. http://bit.ly/2SCjfkw

Stock Trends 2020 Conclusion

There is a 75% chance that the markets will experience at least one strong pullback this year, it would be foolhardy to attempt to predict the exact date though it would be ideal if this event took place during the 1st quarter. Market Update Feb 20, 2020

This correction is taking place in the ideal timeline so it when it ends it will lead to a spectacular rally, those waiting for the crosswinds to subside will (as always) be left holding a can with rotting worms.

The masses beg for an opportunity to buy stocks at a lower price when that opportunity arises the masses panic stating that they need to wait for things to get better before jumping in again. And so they wait, and when things finally get better, they notice that the price of everything they wanted to buy is higher than it was before and so starts the next stage of sorrow.

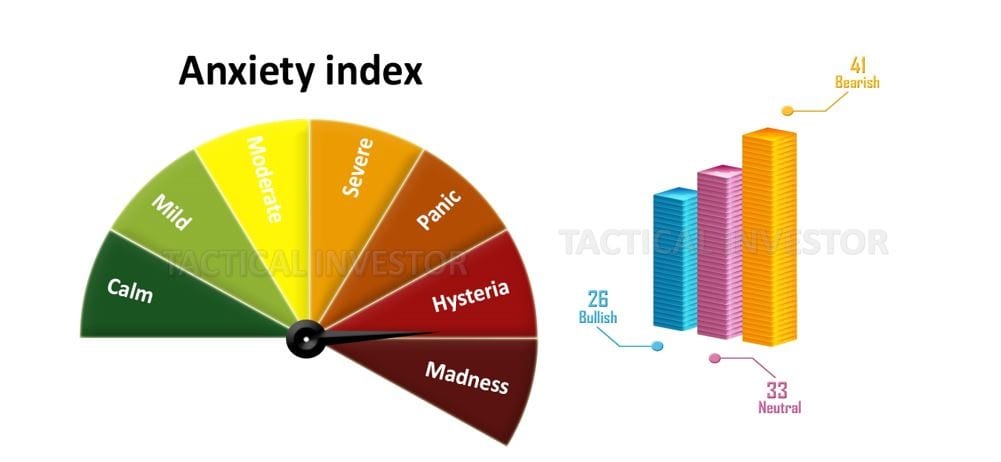

Notice anything odd above in terms of market sentiment. The markets have sold off, so one would expect bearish readings to soar north off 55. Instead, while they have risen, they are only at 41. What’s very interesting is that the number of individuals in the neutral camp is holding steady at 33 and this confirms that the masses are still uncertain, which means that the rebound from this correction will push the market to new highs.

This market has yet to experience the “feeding frenzy stage,” and we expect the action to be twice as powerful as the current downward action gripping the markets. We expect the Dow to experience upward moves ranging from 500 to 1000 points several times before the market even come close to hitting a massive long term top. The needle on the anxiety gauge has swept deep into the hysteria zone extremely rapidly indicating the crowd is one stop from moving into a zone that until now, we did not create “the madness zone”. If the gauge moves into this zone, then we could end up having an event that will come to be known as the “father of all buying events.”

Courtesy of Tactical Investor

7 Hot Stocks for 2020’s Big Trends

With 2019 coming to a close, it’s both a time to reflect and to ponder the future of hot stocks for 2020. If I had to summarize the markets this year in one word, it’d be China. Through much back-and-forth rhetoric, the U.S.-China trade war dominated the investment and political narrative. Unfortunately, based on recent presidential threats, this conflict could be with us for a while.

But if we finally get a substantive trade deal signed, one of the biggest catalysts for hot stocks for 2020 will be technology. Over the years, we’ve seen small upstarts disrupt long established markets. For the next few years, I’m going to go out on a limb and suggest that the old dogs will play new tricks. Specifically, the 5G rollout offers giant, well-resourced organizations a second wind.

Of course, forecasting the most profitable hot stocks for 2020 is a gargantuan task. Still, I think a reliable factor that you can trust is demographics. Although most countries undergo serious social change, arguably few nations are subject to dramatic paradigm shifts like the U.S. Particularly, the aging of two key demographic groups may offer substantial returns for the patient investor.

Lastly, evolving social mores and rising awareness will most likely impart political transitions. And that will invariably impact industries that depend on favorable public sentiment to catalyze growth. So, without further ado, here are my picks for seven hot stocks for 2020 to consider Full Story

20 of the Top Stocks to Buy in 2020

Before we get to the stocks, let’s acknowledge that these lists are tough.

Choosing the best stocks to buy today depends so much on your individual financial situation. To get a good read on where you stand, read our How to Invest Guide. It walks you through topics like establishing an emergency fund, asset allocation, when it makes sense to buy stocks, etc.

Now, onto the 20 stock ideas. Here’s the entire list, followed by the summary buy thesis for each one.

The Vanguard Total Stock Market ETF (NYSEMKT:VTI)

The Vanguard Total International Stock ETF (NASDAQ:VXUS)

Amazon.com (NASDAQ:AMZN)

Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL)

Facebook (NASDAQ:FB)

Intuitive Surgical (NASDAQ:ISRG)

Axon Enterprises (NASDAQ:AAXN)

AT&T (NYSE:T)

Verizon Communications (NYSE:VZ)

Ford Motor Company (NYSE:F)

General Motors Company (NYSE:GM)

ONEOK (NYSE:OKE)

TerraForm Power (NASDAQ:TERP)

Brookfield Infrastructure Partners L.P. (NYSE:BIP)

CareTrust REIT (NASDAQ:CTRE)

iRobot (NASDAQ:IRBT)

lululemon athletica (NASDAQ:LULU)

Wayfair (NYSE:W)

Netflix (NASDAQ:NFLX)

Constellation Brands (NYSE:STZ)

The first two are a bit of a cheat because they’re actually exchange-traded funds (ETFs). ETFs allow you broad exposure to a basket of stocks, and these two are some of the best low-cost index funds around:

US Stocks: The Vanguard Total Stock Market ETF

Foreign Stocks: The Vanguard Total International Stock ETF

The first ETF (VTI) gives you exposure to basically the entire U.S. stock market by investing in over 4,000 stocks. Full Story