China has unveiled the world’s first ‘unhackable computer network’

China has successfully tested the Jinan Project, and is set to begin using the system by the end of August. This marks a world milestone in the development of quantum technology, and identifies China as one of the world leaders in the field.

By the end of August, China plans to rollout the Jinan Project — the world’s first unhackable computer network, which is based on quantum principles. The project uses the city of Jinan as a quantum computer hub that boosts the Beijing-Shanghai quantum network due to its central geographical position between the two larger cities.

Specifically, the network alerts both users to any tampering with the system — as tampering alters the information being relayed. The disturbance is instantly recognizable and both parties can immediately identify when something is amiss.

Zhou Fei, Assistant Director of the Jinan Institute of Quantum Technology, sees the system having worldwide ramifications. He told the Financial Times that “We plan to use the network for national defense, finance and other fields, and hope to spread it out as a pilot that if successful, can be used across China and the whole world.”

By implementing the quantum computer network, China will become the first country to implement quantum technology for a real life, commercial end. It also marks China as a quantum leader worldwide — a status that is reinforced by their development of the Heifei machine, which could eclipse all current supercomputers, as well as their successful transportation of a photon from a satellite in space using quantum physics. Full Story

Technology is changing at such a fast pace, that what took 100 years to achieve a few years ago, could soon be achieved in under five years.

Substandard metal parts used in Japan’s bullet trains

Planes, trains and automobiles — Kobe Steel’s fake product data scandal has now touched every major form of transportation. Two big Japanese railway companies said Thursday that substandard parts from Kobe Steel (KBSTY) were used in the manufacturing of several bullet trains.

The scandal came to light Sunday, when Kobe Steel said employees had falsified data about the strength and durability of thousands of tons of aluminum and copper parts sold between September 2016 and August 2017. They did not meet specifications agreed with customers. Central Japan Railway (CJPRY), which operates high speed trains between Tokyo and Osaka, found aluminum parts used in the truck — the part that connects the wheels to train cars — failed to meet company standards, said spokesman Atsuo Utano. A total of 310 tested parts were found to be substandard. Full Story

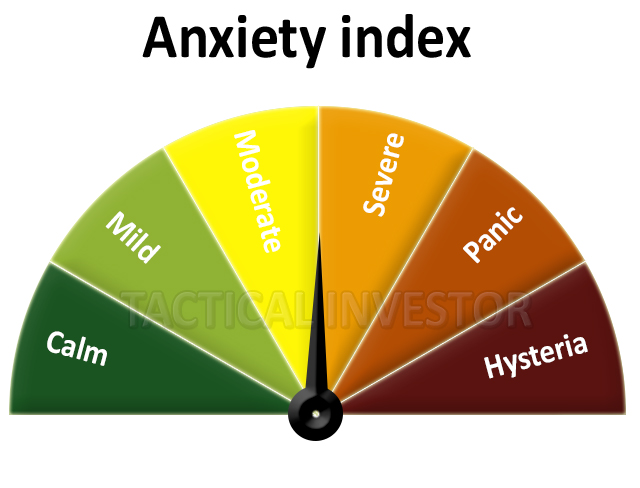

The fallout from this will be big, and while most will not see the connection, this falls in line with the theme we laid out for 2017. That theme in case you have forgotten is “polarisation”. Japan just took a massive hit, and its reputation will be tarnished for a long time. China will use this to elbow its way in, and countries will start becoming nationalistic; you will start to hear variations of our product is better than theirs going forward.

On a separate note, this hiccup will put to rest any hopes Japan might have had of raising rates in the future. A plethora of nations is refusing to raise interest rates because there are more disruptive technologies about to come into play. We will expand on this in a future update, but the medical sector which has been immune to deflationary pressures is going to be ripped apart suddenly. As no one is expecting it, the fallout will be immensely painful (particularly for hospitals and many of their staff), and the higher education sector is just waiting to be taken apart. Deflationary forces are not going to go away anytime soon. The billion dollar question is whether inflationary forces can exert their effect in the face of so many deflationary factors.

BNP Paribas is unveiling a new trade matching tool that uses artificial intelligence

NP Paribas (BNPQY) is unveiling a new trade matching tool that uses artificial intelligence and says it will be ready for MiFID II, the European banking regulation that takes effect in early 2018. “We do a lot of trade matching for our clients – which is, matching the trade of our clients with the broker they have contracted with,” said Patrick Colle, CEO and General Manager of BNP Paribas Securities Services. “30% of trades do not match or need to be repaired – so here comes artificial intelligence.”

Colle said the algorithms comb through data and find reasons why a trade doesn’t match. The tool, called Smart Chaser, has a 98% accuracy rate. Full Story

Forget about complying with new EU banking regulations, the main focus is that AI is once again outperforming humans and this means that this bank is destined to fire at least 60,000 workers if not more in the not too distant future.