Fiat Currency: Instruments of Mass Destruction

We are entering a new paradigm; get used to forever QE, though it will be given other names along the journey to make it appear more palatable. The US and by default worldwide debt is set to soar to preposterous levels; if a national debt of almost $22 trillion is shocking to some; imagine how they will feel when the debt soars to $100 trillion. Market Update Feb 28, 2019

If you shook your head vigorously when you read the above statement, print it and put it somewhere, you can easily access and then review it a few years from today. You will be unpleasantly surprised to see how much the situation has changed; the masses are not paying any attention to the national debt.

Central bankers have become very adept at deflating a nation’s currency while maintaining the illusion all is well. This is achieved by subsidising key industries, using a basket of goods that (and the sectors these goods originate from are usually the one’s receiving massive subsidies) paint a false picture regarding inflation and most importantly, they control the media. Let’s briefly look at some of these subjects today.

The press and the crowd effect

Any student of history can spot a pattern that goes back to ancient times; the powers that be knew that the key to controlling the masses was to control the news outlets. In the old days that meant having control of the gossipers, as time passed on, the name gossiper was replaced with the term reporter. Today’s reporters are only concerned with the number of eyeballs they can attract to a given story; it does not help that the people that hire them also encourage this behaviour. The press is the most potent weapon available; it can destroy a person even if he is 100% innocent. Mass media’s sole function is to manipulate the masses; think about it mass media is not for the observer or for the critical thinker; it’s for cows who are begging to be led to the slaughterhouse, hence the term mass media. If you want to have a good idea of what is really going on; you will read several sources that are not widely referenced by the masses and then use that (collective) data to paint a picture.

Elias Canetti’s view on crowd behaviour is spot on:

It is only in a crowd that man can become free of this fear of being touched. That is the only situation in which the fear changes into its opposite. The crowd he needs is the dense crowd, in which body is pressed to body; a crowd, too, whose psychical constitution is also dense, or compact, so that he no longer notices who it is that presses against him. As soon as a man has surrendered himself to the crowd, he ceases to fear its touch.

That is the mass mindset for you, individuals feel great when they all share a common theme and a so-called common goal, but nature clearly states that everyone cannot win and that there has to be a loser or losers for every winner as it depends on how much the winner takes home. 10 losers might be needed to fund one big winner. Teamwork never pays off except for the person that is pushing the concept of teamwork. Misery loves company; how rare it is to find a group that is happily sharing positive stories; bragging does not constitute a positive development, in fact, it is usually a sign of mental instability.

Subsidising goods

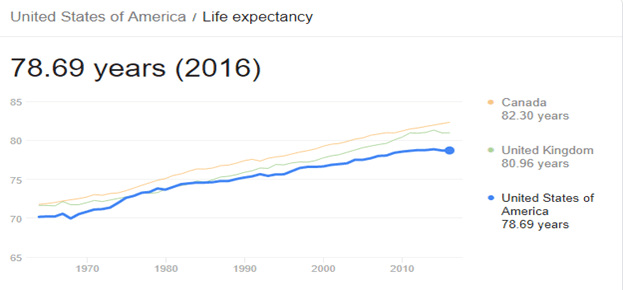

The idea here is to keep critical products at prices that appear to be reasonable. If essential items become too expensive to purchase, the crowd will scream. However, if they have access to reasonably priced education via public schools and colleges, access to affordable food and other basic necessities, then one can create the illusion that inflation is not an issue. So when we state that inflation is a non-event, we are using the Fed’s distorted figures to make this point. In reality, inflation is a massive problem. Just look at the cost of housing, which includes buying or renting, one can easily see that inflation is an enormous problem. Another area is medicine; anyone with a brain can see that inflation in the medical sector is alive and thriving.

Getting the mass to believe old newspapers (your paper money) is real money

In this area, they have been incredibly successful; very few of today’s young generation even understands the concept of hard cash or what constitutes real money. They assume fiat is real and they are now embracing digital forms of fiat such as Bitcoin. This means that the central bankers are now in a position to inflate the money supply beyond the wildest dreams of their predecessors. There will be a day of reckoning but those waiting for that day will probably see their day of reckoning first. Until the masses start to doubt Fiat money, nothing will change; the masses are showing no signs of resisting Fiat. So no matter what the hard money expert’s spout, their knowledge is useless for nothing will happen until the masses reject Fiat. Just like the stock market is unlikely to crash until the Masses embrace this bull market.

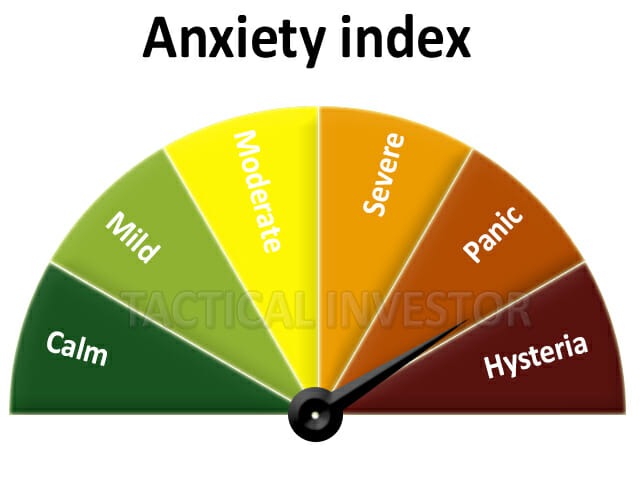

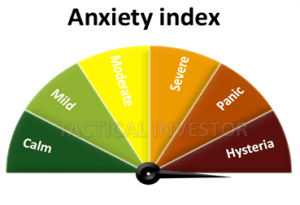

Emotions govern everything, and if you can identify the emotion driving the masses, you can profit from almost any situation.

Central bankers have suddenly changed their chant

What is remarkable is the speed at which central bankers changed their tune and how equally fast and without question, the masses accepted this change.

Nobody is objecting to QE, 10 years ago, they made a big noise, but now the populace at large believes it is a necessity. Let’s start off with the quote we posted by Clarida in the last update, for it clearly tells us that the Fed is not going to stop supporting the stock market, but in fact, it will take even more drastic measures to help the markets in the future. Let the contents slowly sink in, and you will understand why Central bankers will not stop deflating the currency until the masses scream bloody murder and by then it will be too late.

Clarida acknowledged no doubts. He said that radical monetary policy has worked, that it will continue to work, and that it may well become more radical. He contended that low-interest rates are here to stay and that new policy “tools” must be sharpened and kept at the ready.

U.S. inflation forecasts decline, supporting rate-hike holiday

The survey of consumer expectations, published on Monday, is one of the Fed’s price gauges as it weighs the need for rate rises. It showed one- and three-year ahead inflation expectations were down 0.2 percentage points to 2.8 percent last month, with sharp declines in expected medical care expenses. Both the one- and three-year gauges had been roughly unchanged since April 2018.

Stable and low inflation is one of the main reasons that the U.S. central bank, having raised interest rates four times last year, is now taking a wait-and-see approach to any more tightening in 2019.

The New York Fed’s survey found that consumers expected tame inflation despite also forecasting their own wages would rise. Average one-year earnings growth expectations increased to 2.5 percent last month, from 2.4 percent the month before. Consumers also forecast a lower likelihood that unemployment will rise. Economists are debating whether rising wages and low unemployment figures still translate into higher inflation as orthodox economic theory assumes. Full Story

ECB holds interest rates steady to curb Eurozone slowdown

Policymakers at the European Central Bank on Thursday announced a new round of cheap loans to banks and said record low-interest rates would remain unchanged “at least through the end of 2019.”

Previously, the bank had indicated that the earliest rate hike would come in the fall. The measures aim to allay fears of a eurozone slowdown spurred by uncertainty over Brexit, a US-China trade war, and threats by Washington to impose tariffs on European auto imports.

“We’re coming out of, and maybe we still are in a period of, continued weakness and pervasive uncertainty,” ECB chief Mario Draghi told reporters in Frankfurt.

“Our decisions certainly increase the resilience of the eurozone economy,” he added. “But can they address the factors that are weighing on the economy in the rest of the word? They cannot.”

Carsten Brzeski, the chief economist at the bank ING Germany, said the measures came surprisingly early.

“It is clearly an attempt to stay ahead of the curve,” he said. “Any next step from here to tackle a severe downswing of the economy would now require unprecedented measure. Full Story

Global economy: Why central bankers blinked

The wariness descending over leading central banks is a jarring contrast to the buoyant mood this time last year. At the gathering of business and political leaders in Davos, Switzerland in January 2018, optimism was simmering, with one survey of bosses putting confidence at its highest for six years. The IMF hailed the broadest synchronised global upsurge since the start of the decade, with 120 economies enjoying a pick-up in growth.

An update from the IMF last month bemoaned the “backdrop of weakening financial market sentiment, trade policy uncertainty, and concerns about China’s outlook”. Growth in advanced economies will slow from an estimated 2.3 per cent in 2018 to 2 per cent in 2019 and 1.7 per cent in 2020, it said. Global manufacturing activity is at a two-and-a-half year low.

“You are getting a much more sober assessment of global growth,” says Mohamed El-Erian, chief economic adviser at Allianz.

What has gone wrong? The sea change reflects, in part, a realisation that policymakers became overly bullish last year, says Mr El-Erian. The Fed, in particular, over-reached by signalling four increases in interest rates for 2018 when the global economy was still fragile, he says. Its new-found caution is providing “air cover” for other central banks to mark down their own rate expectations. Full Story

What do these headlines indicate?

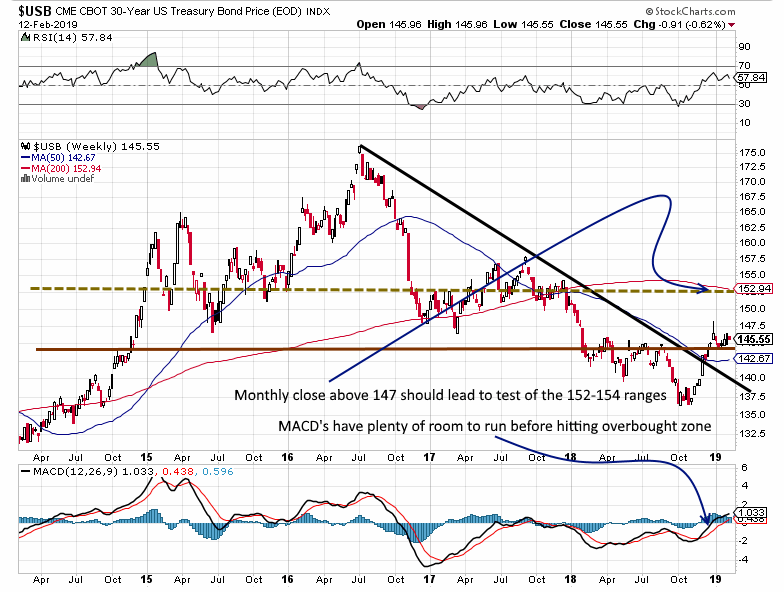

These stories confirm that we were on the right track when we stated that the Fed had no intention of pushing rates too high for the past 24 months. We pointed to the reaction from the bond markets, Baltic dry index, the world economy, etc.; these indicators showed that this rate hike scheme was nothing but a game of smoke and mirrors. This manipulation of the money supply is going to affect the stock markets dramatically; every single expert that refuses to adapt will be flung under the bus; there will be no exceptions.

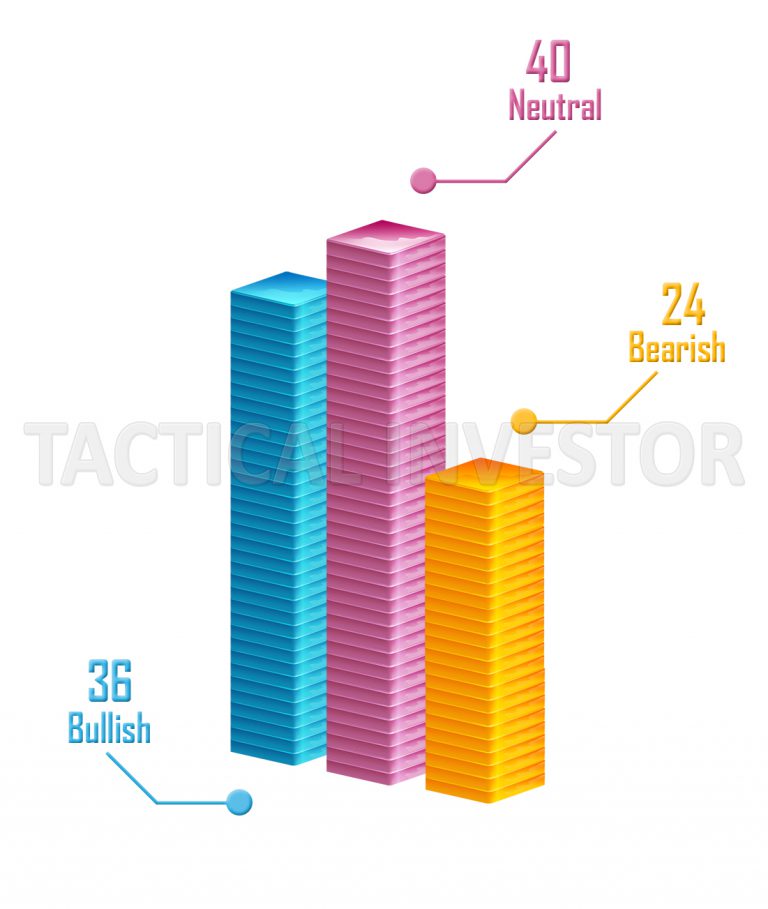

The markets will experience many corrections ranging from wild to mild, but almost all of them will prove to be buying opportunities unless the trend changes. If one takes a look at the megatrend (megatrends are ultra-long term trends) then every back-breaking correction has to be embraced; however, by employing human emotion as a timing indicator, we can determine the optimum time to jump in and out of the markets.

Easy Money altering Market Dynamics

Such vast amounts of money sloshing around can alter the picture dramatically; what should happen in most cases does not. Under normal circumstances, precious metals should have soared to the moon, inflation should have been rampant, commodities (in general), should have risen in value. The housing sector should have tanked as rates would have risen in an inflationary environment, hundreds of business should have filed for bankruptcy, the stock market should have experienced another back-breaking correction, and the list of woes goes on. But almost none of the above has occurred, which clearly indicates that the old tools economists and financial experts are relying on are practically useless.

Random Quotes About Fiat Currency

“Growth for the sake of growth,” says Edward Abbey, “is the ideology of the cancer cell.”

“Anyone who believes exponential growth can go on forever in a finite world is either a madman or an economist.” economist Kenneth, Boulding

“If corporations are indeed ‘persons,’,” David Niose writes in Psychology Today, “their mental condition can accurately be described as pathologic

Interesting article on how Fiat destroys cultures

https://mises.org/wire/how-fiat-money-destroys-culture

Fiat Currency Helps Foster Chaos

Be prepared for the unprepared and remember everything can change but human emotions never do; 90% of humans are wired to do the exactly the same thing at precisely the wrong moment, ensuring that the maximum amount of damage will be inflicted by their ill-planned actions. If you can identify the emotion driving the masses, it is not too hard to find a way to stay out of harm’s way.

However, every problem ranging from declining moral standards, corrupt politicians, surge in wars, political polarisation, and a host of other terrible factors, can in some way be attributed to FIAT Money. As the money supply increases, the situation will continue to deteriorate. Freedom levels have to be curtailed the more a nation debases its currency and nowhere will this been seen more clearly in the US. Think about how much freedom we have lost since 911 and how the national debt soared after it.

Taking things are a step further

This 2-hour movie is an excellent starting point as to why the Top Players go out of their way to control the masses. The idea has always been to target the next generation at the earliest age possible, and with the passage of time, these guys are getting better and better at this game. This video covers a lot more than this concept, hence the length, it definitely makes for an interesting watch.

Final Parting Thoughts on Fiat Currency

Never wear your emotions on your sleeves; observe and use the data to formulate a plan. If one is part of the emotional chaos, one cannot see or hear anything other than the picture they are being directed to examine. Only a calm mind can see what is going on. You have a millisecond to question the emotion that is about to take over; will you examine it and in doing so open a new door, or will you allow it to take over and lead you astray. Insanity is doing the same thing over and over again and hoping for a new outcome. New outcomes come from new actions, not hope; change the angle of perception and in doing so change the outcome.

Courtesy of Tactical Investor

It’s just that for a long time it existed under different names the primary one being philosophy. As they say history repeats itself over and over again and the past is actually a window into the future. One good book that should be compulsory reading for all traders is a book titled “Michel de Montaigne – The complete essays”. You can pick this up for as little as 10 dollars from Amazon. This Gentleman was born in the 1500’s and his writings display an incredible.

It’s just that for a long time it existed under different names the primary one being philosophy. As they say history repeats itself over and over again and the past is actually a window into the future. One good book that should be compulsory reading for all traders is a book titled “Michel de Montaigne – The complete essays”. You can pick this up for as little as 10 dollars from Amazon. This Gentleman was born in the 1500’s and his writings display an incredible.