Different economies exhibit varying velocity of money equations, reflecting their level of development. This metric fluctuates in line with business cycles. During economic expansions, spending surges, elevating the velocity of money. Conversely, economic contractions lead to cautious spending and a decline in the velocity of money.

Linked to key economic indicators, the velocity of money typically rises alongside GDP and inflation, and vice versa in contracting economies. The Fed’s equation MV = PQ defines the velocity of money, emphasizing the impact of money supply growth on inflation. However, real-world complexities challenge this direct relationship.

Factors influencing persistent low inflation encompass changes in the velocity of money due to shifts in consumer and business behavior, economic conditions and confidence, central bank actions, and additional factors beyond money supply and output, such as labor markets, productivity, global trade dynamics, and government policies. These intricate interplays debunk the simplicity of the velocity of money equation, as evident during the 2008-2013 period.

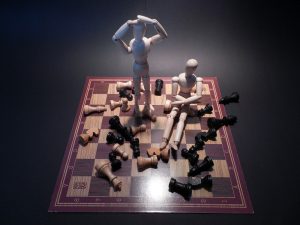

Velocity of Money Equation and the Impact of AI Disruption

The declining velocity of money raises concerns about the true strength of the economic recovery. A possible explanation lies in the growing influence of artificial intelligence (AI). As AI disrupts traditional business practices and industries, the workforce faces an uncertain future.

The rise of AI and robots signals a potential new world order for the job market. AI-powered robots are poised to replace a significant portion of the human workforce, as evident in Tesla’s plans to create a humanoid robot. This shift in the workforce landscape could have profound implications for the economy and the demand for traditional labor.

Low velocity of the monetary base also hinders economic growth, as each dollar in the monetary base is utilized only 4.4 times, down from the pre-recession figure of 17.2. Despite the substantial increase in the monetary base, nominal GDP has seen minimal changes due to the counteracting impact of declining velocity.

The unprecedented demand for money disrupts the velocity of money, as people prefer to hoard money as a risk-free asset rather than spend it. The decline in interest rates further contributes to this trend. As a result, the velocity of money has been plunging since 1996, indicating potential economic challenges and contraction.

In summary, the velocity of money equation encounters challenges due to AI disruption, low velocity of the monetary base, and unprecedented money demand. These factors suggest the need for a holistic approach to address economic complexities and prepare for the evolving workforce landscape shaped by AI.

The Ominous Decline: Unraveling the Velocity of Money Equation

A concerning trend emerges as the velocity of money continues to plummet, raising red flags about the state of the economy. Without the constant injection of money supply, the illusion of prosperity may dissipate rapidly. The Federal Reserve shows no signs of halting their monetary expansion; they may ease one program but will swiftly implement another. However, this trajectory leads to a foreboding conclusion: the impending demise of the human workforce.

Inflation discussions require careful consideration of reference points, as cherry-picking data to fit preconceived arguments is akin to mere curve fitting. This deceptive tactic can turn garbage into apparent roses.

Puzzling Insights into the Velocity of Money Conventional wisdom dictates that the velocity of money should rise with GDP growth and economic expansion. Moreover, it should surge when consumer spending increases. Alas, reality defies these assumptions. The field of economics, dubbed the “dismal science,” often leaves experts and PhD economists trailing behind monkeys wielding darts in performance.

Einstein’s “spooky action” quantum entanglement seems more aptly named for economics, given how handsomely paid experts are, despite their consistent track record of being wrong.

The declining velocity of money equation paints a worrisome picture, demanding a deeper understanding and a fresh perspective on the economic landscape.

FAQs

Q: What is the velocity of money equation?

A: The velocity of money equation is represented as V = PQ/M, where V stands for the velocity of money, P represents the general price level, Q is the quantity of goods and services produced, and M denotes the money supply.

Q: Why is the declining velocity of money concerning?

A: The declining velocity of money indicates potential economic challenges and raises questions about the state of the economy. It suggests that the magic cycle of prosperity may be at risk, and the continuous injection of money supply might be masking underlying issues.

Q: Will the Federal Reserve stop pumping money into the economy?

A: No, the Federal Reserve is likely to continue its monetary expansion efforts. While they may halt or adjust specific programs, they are expected to employ alternative measures to sustain economic growth.

Q: How does inflation relate to the velocity of money equation?

A: Inflation discussions require careful consideration of reference points, as selecting data to fit specific arguments can be misleading. Using curve fitting to support claims can create deceptive perceptions about inflation rates.

Q: Does the velocity of money behave as expected in economic scenarios?

A: Contrary to conventional wisdom, the velocity of money often behaves unpredictably. While it is believed to rise with GDP growth and consumer spending, real-world observations challenge these assumptions.

Q: Why is economics often called the “dismal science”?

A: Economics is often referred to as the “dismal science” due to the challenges in accurately predicting economic outcomes. Even experts and economists with PhDs tend to make frequent errors in their predictions.

Q: What does the decline in velocity of money signify for the human workforce?

A: The decline in velocity of money could foreshadow changes in the workforce landscape, potentially impacting job opportunities and job security, especially with the rise of technological advancements like AI.

Q: How should we interpret the trend of the velocity of money?

A: The declining trend of the velocity of money demands a deeper understanding of its implications for the economy. It requires a fresh perspective and careful analysis to navigate its potential effects.

Other Articles of Interest

The Art of Geopolitical Risk Analysis: Enhancing Your Investment Strategy

Avoiding Common Day Trading Mistakes: Strategies for Success in the Stock Market

Dow Jones Utility Index as a Stock Market Timing Indicator

Velocity of Money Equation: A Holistic Perspective

Penny Stocks for Dummies: Embrace Courage and Ride the Waves

Exploring the Essence of Contrarian Thinking Review

The Impact of Contrarian Outlook Reviews

Exploration of collective behavior and Its Implications

Mass Formation Psychology: Understanding Collective Hypnosis

Stock Market Basics

Semiconductor Industry News