Understanding Geopolitical Risk Analysis

Geopolitical risk analysis involves assessing the impact of political events and global relations on financial markets. Investors must consider how factors like international conflicts, trade policies, and diplomatic relations can influence market stability and investment opportunities. The complexity of global politics means that these risks can manifest unexpectedly, making it essential for investors to stay informed and prepared.

For instance, events such as Brexit or tensions in the South China Sea can create ripples in financial markets, affecting everything from currency values to stock prices. Understanding how these geopolitical events influence market cycles is crucial for making informed investment decisions.

The Impact of Mass Psychology on Investment Decisions

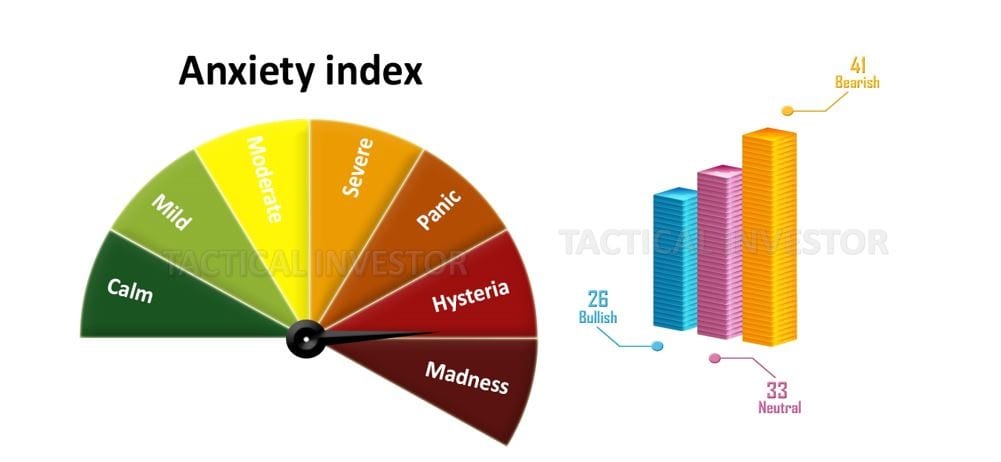

Mass psychology plays a significant role in how geopolitical events influence investor behavior. During times of uncertainty, such as the onset of a military conflict or a significant political shift, investor sentiment can shift dramatically. This fear or optimism can lead to herd behavior, where investors collectively react to news, often resulting in overreactions in the market.

As George Soros famously pointed out, “The prevailing bias is that the market is always right.” This suggests that even when the fundamentals suggest otherwise, the emotions and reactions of the market participants can dictate price movements. For example, during the Gulf War in the early 1990s, the uncertainty led to panic selling, despite the underlying economic fundamentals remaining stable.

Cognitive Biases and Geopolitical Risk

Cognitive biases can significantly impact how investors perceive and react to geopolitical risks. One common bias is the availability heuristic, where individuals rely on immediate examples that come to mind when evaluating a specific topic. For instance, if investors frequently hear news about geopolitical tensions, they may overestimate the likelihood of those tensions affecting their investments.

Warren Buffett emphasizes the importance of rational analysis, stating, “It’s only when the tide goes out that you learn who’s been swimming naked.” This highlights the need for investors to look beyond their immediate emotions and biases, especially when assessing geopolitical risks. By doing so, they can avoid making hasty decisions based on fear or speculation.

Technical Analysis in Geopolitical Risk Assessment

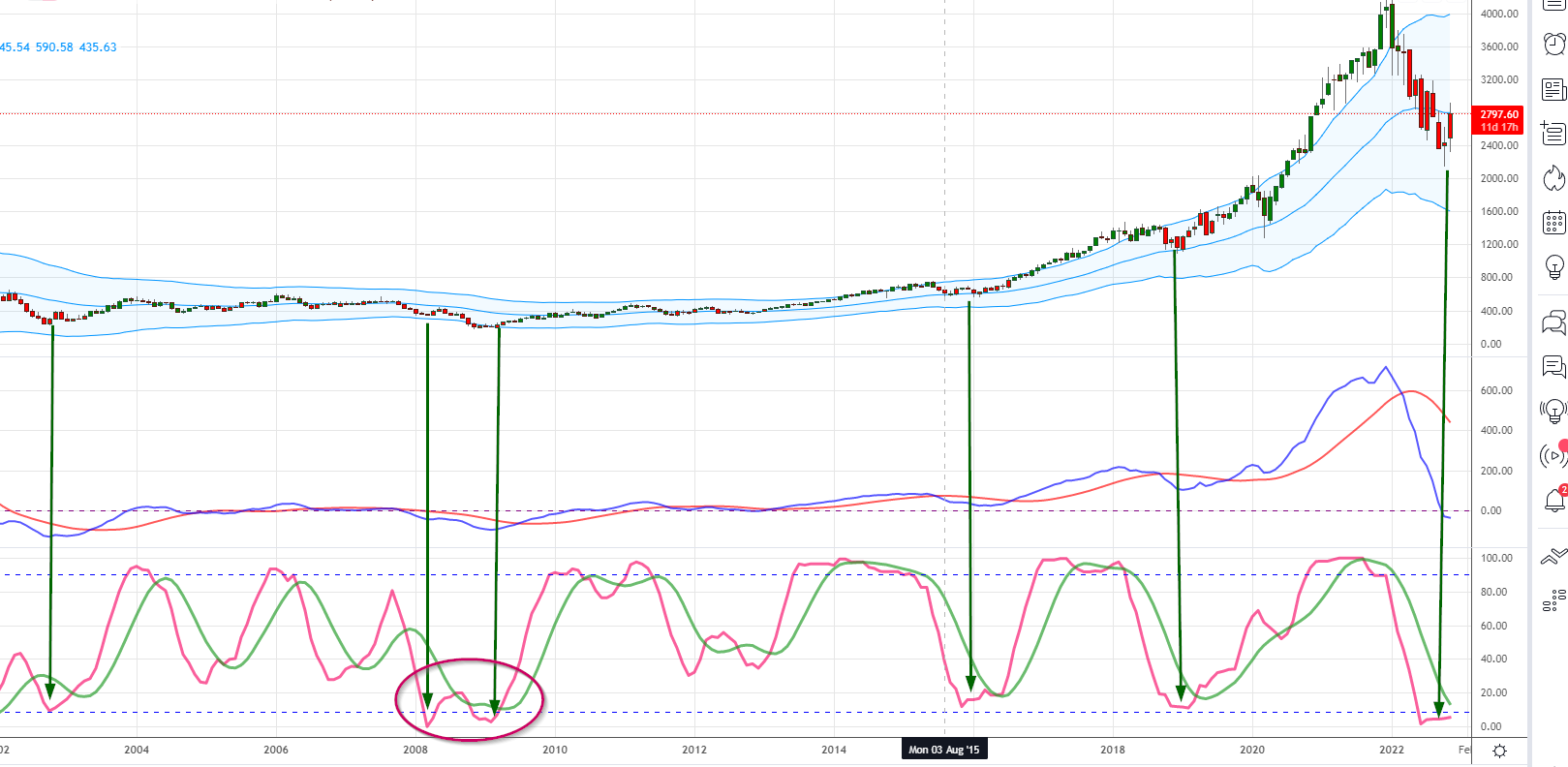

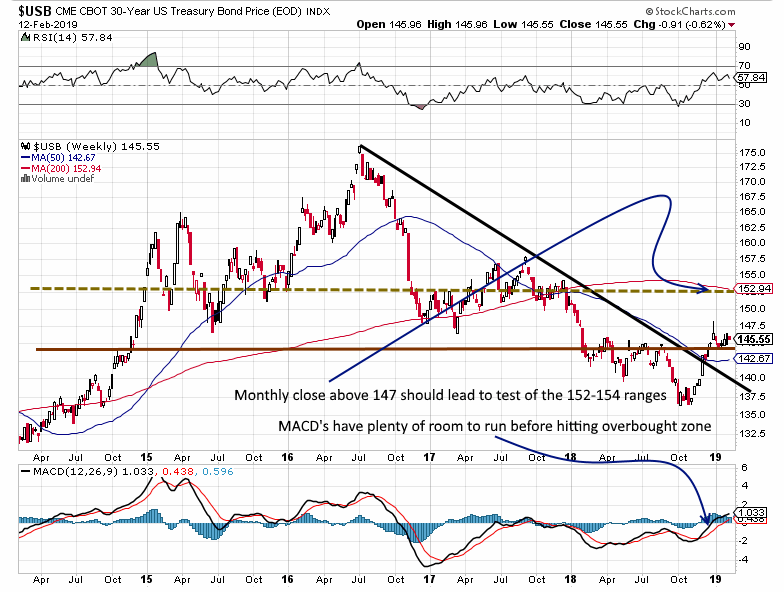

Technical analysis can serve as a useful tool for investors assessing geopolitical risks. By analyzing price movements and trading volumes, investors can identify patterns that may suggest how markets are reacting to geopolitical events. For example, an increase in volatility may indicate that investors are becoming anxious about potential geopolitical developments.

William O’Neil, a prominent investor and author, developed a methodology that combines fundamental and technical analysis. His CAN SLIM strategy emphasizes the importance of understanding market sentiment—an essential component when geopolitical risks are at play. When major geopolitical events occur, analyzing technical indicators can help investors gauge market reactions and adjust their strategies accordingly.

Real-World Examples of Geopolitical Risk Analysis

One notable example of geopolitical risk impacting markets occurred during the Arab Spring in 2011. The widespread protests and political upheaval across the Middle East created a wave of uncertainty that affected global oil prices. Investors who closely monitored these developments and their potential implications for oil supply were able to adjust their portfolios accordingly. Those who reacted quickly to the geopolitical alerts could hedge against rising oil prices and mitigate losses in their investments.

Another example is the ongoing trade tensions between the United States and China. As tariffs were implemented and negotiations stalled, markets reacted with increased volatility. Investors who conducted thorough geopolitical risk analysis were better positioned to navigate these fluctuations, making strategic decisions that capitalized on market movements.

The Role of Economic Indicators

Economic indicators often provide critical data points for assessing geopolitical risks. Factors such as inflation rates, unemployment figures, and GDP growth can offer insights into the health of an economy and its vulnerability to geopolitical events. Ray Dalio, founder of Bridgewater Associates, emphasizes the importance of understanding these macroeconomic factors in investment strategies. He argues that analyzing economic indicators can provide context for recognizing shifts in market cycles influenced by geopolitical developments.

For instance, if economic indicators suggest that a country is on a stable growth path, investors may be more inclined to overlook minor geopolitical tensions. Conversely, if economic data points to a fragile economy, even slight geopolitical risks may trigger heightened anxiety and market volatility.

Long-Term Strategies in Geopolitical Risk Analysis

Investors can adopt various strategies to mitigate risks associated with geopolitical events. A long-term investment approach, championed by figures like John Bogle, emphasizes holding quality assets through market fluctuations. By focusing on fundamentally sound investments, long-term investors can ride out the volatility created by geopolitical tensions.

Alternatively, adopting a more active trading strategy may be appropriate for those who prefer to respond quickly to geopolitical risks. Jim Simons, known for his quantitative trading strategies, has successfully navigated market fluctuations by leveraging data analysis to identify patterns in price movements. Investors can use similar strategies to capitalize on short-term opportunities created by geopolitical events.

Diversification as a Risk Management Tool

Diversification remains a key strategy for managing geopolitical risks. By spreading investments across various asset classes and geographic regions, investors can reduce their exposure to any single event. Philip Fisher, an influential investor, argued for the importance of investing in a range of sectors to mitigate potential risks. This approach allows investors to balance their portfolios during geopolitical uncertainties.

Carl Icahn, a prominent activist investor, also advocates for diversification as a means to safeguard against geopolitical risks. By considering opportunities across different industries and markets, investors can build a more resilient portfolio that can withstand shocks arising from geopolitical developments.

Technological Innovations and Geopolitical Risk Analysis

In today’s digital age, technology is increasingly essential for conducting geopolitical risk analysis. Advanced data analytics tools allow investors to rapidly assess global events and their potential impacts on markets. These tools can provide real-time alerts and insights, helping investors stay informed and make timely decisions.

Jesse Livermore, a legendary trader, understood the importance of timing in investments. Although he operated in a different era, his principles remain relevant. Modern investors can leverage technology to enhance their market timing and respond effectively to geopolitical risks, utilizing data to make informed decisions about their portfolios.

Conclusion: The Importance of Geopolitical Risk Analysis

In summary, geopolitical risk analysis is a critical component of modern investment strategies. By understanding the interplay between political events, market psychology, cognitive biases, and technical analysis, investors can make more informed decisions. The teachings of renowned experts such as Warren Buffett, Benjamin Graham, and Ray Dalio provide valuable guidance for navigating these complexities.

Ultimately, those who remain vigilant in their geopolitical risk analysis will be better equipped to seize opportunities and manage risks in an increasingly interconnected world. By honing their skills in assessing geopolitical risks, investors can position themselves for success and achieve long-term financial growth.

The Art of Geopolitical Risk Analysis: Enhancing Your Investment Strategy

Avoiding Common Day Trading Mistakes: Strategies for Success in the Stock Market

Dow Jones Utility Index as a Stock Market Timing Indicator

Velocity of Money Equation: A Holistic Perspective

Penny Stocks for Dummies: Embrace Courage and Ride the Waves

Exploring the Essence of Contrarian Thinking Review

The Impact of Contrarian Outlook Reviews

Exploration of collective behavior and Its Implications

Mass Formation Psychology: Understanding Collective Hypnosis

Stock Market Basics

Semiconductor Industry News